Unlock the Insights

The Chartered Financial Analyst® (CFA) designation is widely acknowledged as the pinnacle of achievement in the finance and investment sectors. For finance professionals, earning the CFA charter brings unparalleled benefits. It not only fuels accelerated career growth but also opens doors to higher salaries, instant respect, and enhanced credibility. Employers worldwide actively seek out CFA charterholders for a range of job roles and responsibilities within the global financial services industry. Whether it's portfolio management, analysis, private wealth management, or consulting, having the CFA certification sets you apart from the competition. With approximately 190,000 CFA charterholders spread across 164 markets worldwide, the CFA charterholder community is a vast network of professionals dedicated to excellence.

Most Common CFA Charterholder Career Paths?

The path to becoming a CFA charterholder is lengthy and demanding; however, the rewards that come with earning the designation makeup for more than all the difficulties encountered along the way. Although a CFA charterholder has access to a wide variety of professional options, the following positions are most often chosen by charterholders:

- Consultant

- Corporate Finance Analyst

- Financial Advisor

- Portfolio Manager

- Relationship Manager

- Research Analyst

- Chief Executive Officer

CFA charterholders also work in banks as investment bankers and in various positions in the accounting profession. In addition to gaining access to countless career opportunities, finance professionals who commit to putting in the time and effort to acquire the CFA charter typically succeed in any career path they choose.

Top Careers for CFA Charterholders

Following is a briefing on the top five careers held by CFA charterholders or candidates currently enrolled in the program. For more up-to-date information, please refer to the U.S. Bureau of Labor Statistics on each of the previously mentioned careers.

- Buy-Side Research – Financial analysts who work for institutional investors rather than individuals are often employed in buy-side research. They research investments and recommend investments to large investors such as pension funds, hedge funds, or mutual funds. Buy-side researchers earn an average of $108,516 per year. These types of positions are growing at 5% annually.

- Consulting – A consultant works within a company to provide financial advice. They advise the company on how best to increase profit and decrease loss. Financial consultants make an average of $89,330 a year, and the job outlook is growing at 11%.

- Investment Banking – Investment banking has several subsectors. They assist with initial public offerings, mergers and acquisitions, underwriting, and long-term analysis. Investment bankers have a wider pay range depending on the sector but average approximately $115,000 per year, with a growth outlook of 15%.

- Risk Management – Risk management occurs every moment of every day in finance. Risk managers research and analyze potential risks with a potential investment. Managers then weigh the risks against the projected return and decide whether the investment matches the fund's overall goals. Risk management analysts earn an average of $72,858 per year. Job growth in this area is around 9% annually.

- Corporate Finance – Typically, when people mention 'corporate finance' in passing, they refer to the highest-paid and most highly regarded financial segment. By comparison, the average annual wage of highly paid executives in corporate finance is around $107,213, with a job outlook of 1%.

Enhancing Your Finance Career with the CFA Charter

For research analysts and asset managers, obtaining the CFA charter is practically indispensable. The comprehensive CFA program encompasses all facets of the finance and investment sectors, making it the ultimate accolade for professionals in investment management and finance. By immersing yourself in this curriculum, you can establish a robust knowledge foundation and develop exceptional technical skills, thereby optimizing your long-term career prospects in the financial industry.

Should you aspire to excel in any of the following fields, the CFA charter can serve as a springboard for your professional journey:

- Portfolio management

- Pension funds

- Hedge funds

- Fund of funds

Furthermore, it's worth highlighting that the demand for CFA charterholders is evident across various occupations, as indicated by the projected 5% increase in finance professionals' employment in the United States by 2029. This growth rate surpasses the average and bodes well not only for aspiring finance professionals but also for the overall U.S. economy. With the positive growth outlook, a multitude of positions within the global finance industry will require the expertise and experience of more finance professionals.

Why the Top Firms Value CFA Charterholders

The primary reason firms prefer CFA charterholders is due to the rigorous and comprehensive nature of the CFA Program, which equips professionals with a broad range of skills and knowledge essential for success in the finance industry. Here are some of the top reasons why firms value CFA charterholders:

- Expertise and Competence: The CFA charter signifies a high level of expertise and competence in finance, investment analysis, and portfolio management. Employers trust that individuals who have earned the charter possess a deep understanding of financial concepts and are equipped to make informed investment decisions.

- Global Recognition: The CFA charter is globally recognized and respected within the finance industry. It demonstrates that the individual has met stringent standards and has undergone rigorous training, making them a valuable asset in both domestic and international markets.

- Ethical Standards: CFA charterholders are bound by a strict code of ethics and professional conduct. Firms value this commitment to ethical behavior and trust charterholders to act in the best interests of their clients, maintaining the integrity of the firm.

- Versatility: The CFA Program covers a wide range of topics, providing charterholders with a versatile skill set. They are well-versed in areas such as financial analysis, asset valuation, risk management, and portfolio construction. This versatility allows them to contribute effectively in various roles within the firm.

- Continued Professional Development: To maintain their charter, CFA charterholders are required to engage in ongoing professional development and stay updated with industry trends. Firms appreciate their commitment to continuous learning, knowing that they will remain knowledgeable and adaptable in a dynamic financial landscape.

- Network and Connections: The CFA charterholder community comprises a vast network of professionals, including charterholders, candidates, and industry leaders. Firms value the potential connections and opportunities that come with hiring CFA charterholders, as they can tap into this network for collaboration, mentorship, and business development.

Networking opportunities available for the CFA charterholders

The CFA charterholder community offers numerous avenues for charterholders to network with peers, industry professionals, and potential employers. Here are some networking opportunities available to CFA charterholders:

- CFA Societies: CFAI has local chapters known as CFA societies in various cities and regions worldwide. These societies organize events, conferences, seminars, and networking sessions specifically for CFA charterholders and candidates. Attending these events provides opportunities to connect with professionals in your local finance community, exchange ideas, and build relationships.

- Online Communities: CFAI provides online platforms and forums where charterholders can engage with fellow professionals, share insights, and seek advice. Platforms like the CFA Connect and LinkedIn groups dedicated to CFA charterholders facilitate networking, knowledge sharing, and collaboration.

- Continuing Education Events: Many CFA Societies and organizations host continuing education events and workshops, covering various finance topics. These events bring together professionals and experts from different sectors, offering opportunities to network and learn from industry leaders.

- Industry Conferences and Seminars: Attending industry conferences and seminars related to finance and investment management can provide valuable networking opportunities for CFA charterholders. These events often attract a diverse range of professionals, including portfolio managers, analysts, researchers, and executives.

- Alumni Associations: Many universities and educational institutions have alumni associations specifically for CFA charterholders. These associations offer networking events, mentorship programs, and access to a network of professionals who have completed the CFA Program.

- Professional Associations and Organizations: Joining professional associations and organizations related to your specific field of interest, such as investment management, financial analysis, or risk management, can provide additional networking opportunities. These associations often have events, conferences, and online platforms where you can connect with like-minded professionals.

Networking as a CFA charterholder can help you expand your professional connections, learn from others in the industry, discover new career opportunities, and stay updated on industry trends. It's important to actively participate in these networking opportunities, engage with peers, and build relationships that can benefit your career advancement and professional development.

Top Companies That Recognize and Embrace CFA Charterholders

The below companies, among others in the finance industry, often value the expertise, competence, and ethical standards that CFA charterholders bring to their organizations. It's worth noting that the presence of CFA charterholders extends beyond these specific companies, and many other financial institutions and investment firms worldwide recognize the value of hiring individuals with the CFA designation.

- JP Morgan Chase

- UBS

- RBC

- Bank of America/Merrill Lynch

- HSBC

- Wells Fargo

- Morgan Stanley

- Citigroup

- BlackRock

- Goldman Sachs

Source: CFA Institute (CFAI)

Many multinational corporations highly prioritize recruiting and promoting CFA charterholders due to the numerous advantages they bring. Employers who invest in the ongoing education of their workforce enjoy several benefits, such as having a highly skilled and knowledgeable staff, positively impacting their financial performance, and fostering employee satisfaction and retention. By providing support and opportunities for growth, organizations not only enhance their employees' training and development but also uncover potential future leaders.

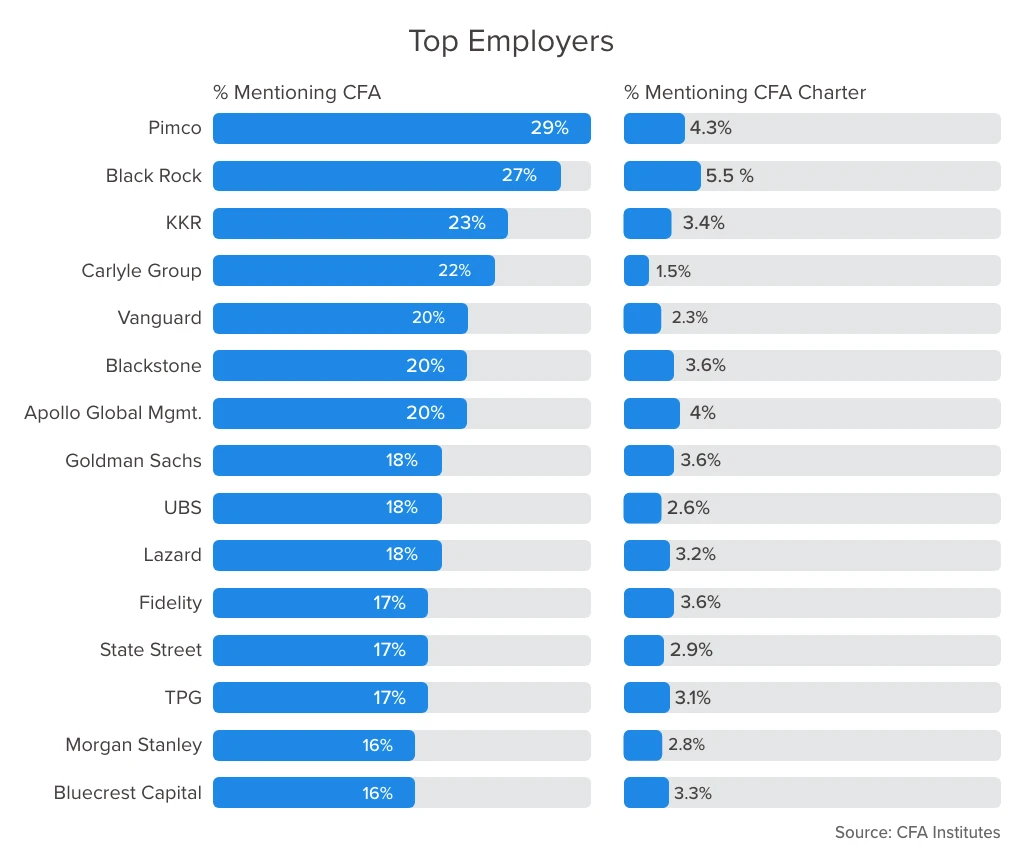

Check out the chart for the top employers in terms of the percentage of their workforce with the CFA designation.

CFA charterholders offer businesses a distinct advantage, as highlighted by the CFAI. Their comprehensive knowledge enables them to delve deeper than surface-level news, identifying specialized prospects for clients. Whether the objective is investing in emerging enterprises or planning for retirement, charterholders possess the requisite expertise. Moreover, they are bound by the CFA Code of Ethics and Standards of Professional Conduct, reaffirming their commitment annually. This commitment ensures that the interests of both the business and clients are prioritized.

Sectors Where The CFA Charterholders Are In Demand

CFA charterholders are highly sought after in various sectors of the financial industry. The CFA Program is a globally recognized qualification that provides a deep understanding of investment analysis, portfolio management, and ethical standards. While CFA charterholders can work in a range of roles, the following sectors often have a high demand for their expertise:

- Asset Management: CFA charterholders are extensively employed in asset management firms, including mutual funds, hedge funds, pension funds, and wealth management firms. Their knowledge of investment analysis and portfolio management makes them valuable for making informed investment decisions and managing client portfolios effectively.

- Investment Banking: CFA charterholders often work in investment banking, particularly in roles related to equity research, mergers and acquisitions (M&A), and corporate finance. Their expertise in financial analysis and valuation techniques allows them to assess investment opportunities, conduct due diligence, and provide strategic advice to clients.

- Equity Research: Equity research analysts, who analyze stocks and provide investment recommendations, benefit from the CFA Program's rigorous curriculum. Many sell-side and buy-side firms require or prefer CFA charterholders to perform in-depth research and make investment decisions.

- Private Equity and Venture Capital: CFA charterholders are sought after in the private equity (PE) and venture capital (VC) sectors. They play a crucial role in conducting due diligence, valuing investments, and assessing potential targets for investment or acquisition.

- Risk Management: Risk management is a critical function in financial institutions. CFA charterholders are well-equipped to analyze and manage financial risks, including market risk, credit risk, and operational risk. They can work in risk management roles in banks, insurance companies, and other financial institutions.

- Financial Planning and Wealth Management: CFA charterholders possess the necessary knowledge and skills to provide comprehensive financial planning and wealth management services. They can work as financial advisors, helping clients with investment strategies, retirement planning, tax optimization, and estate planning.

- Corporate Finance: CFA charterholders are often sought after in corporate finance departments of companies. They can contribute to financial analysis, capital budgeting, investment decisions, and financial planning and analysis.

- Quantitative Finance: CFA charterholders with strong quantitative skills are in demand in the field of quantitative finance. They can work in areas such as quantitative research, algorithmic trading, risk modeling, and quantitative portfolio management.

It's important to note that while these sectors generally have a demand for CFA charterholders, specific job opportunities and requirements may vary depending on the region, industry, and individual companies. Additionally, the CFA designation is just one factor among many that employers consider when hiring, and relevant experience and skills are also highly valued.

Additional designations that complement the CFA charter

There are several additional professional designations that can complement the CFA charter and further enhance your expertise and marketability in specific areas of finance. Here are some notable designations that are often pursued by professionals in conjunction with the CFA charter:

- CAIA (Chartered Alternative Investment Analyst): The CAIA designation focuses on alternative investments such as hedge funds, private equity, real estate, commodities, and structured products. It provides specialized knowledge and expertise in these areas, which can be beneficial for professionals working in investment management, asset allocation, or risk management roles.

- FRM (Financial Risk Manager): The FRM designation is focused on risk management, including areas such as market risk, credit risk, operational risk, and risk modeling. It is particularly relevant for professionals working in risk management, trading, banking, and consulting roles.

- CFP (Certified Financial Planner): The CFP designation is geared towards professionals involved in financial planning, wealth management, and providing comprehensive financial advice to clients. It covers areas such as retirement planning, tax planning, estate planning, and insurance. This designation is beneficial for individuals working in financial advisory roles.

- CPA (Certified Public Accountant): The CPA designation is primarily associated with accounting and auditing. It is relevant for professionals working in financial accounting, financial analysis, and auditing roles. Combining the CFA charter with a CPA can be advantageous for individuals involved in investment research, valuation, or financial reporting.

- CMA (Certified Management Accountant): The CMA designation focuses on management accounting and strategic financial management. It is particularly relevant for professionals working in corporate finance, financial planning and analysis, and management accounting roles.

- CMT (Chartered Market Technician): The CMT designation is designed for individuals with a focus on technical analysis and market forecasting. It is beneficial for professionals involved in technical analysis, trading, and quantitative research.

These are just a few examples of the many professional designations available in the finance industry. The choice of additional designations depends on your career goals, areas of specialization, and personal interests. Pursuing complementary designations can help you deepen your knowledge and expertise in specific areas, broaden your professional network, and differentiate yourself in the job market. However, it's important to carefully evaluate the requirements, costs, and relevance of each designation to ensure it aligns with your career objectives.

How Do Ethics and Professional Conduct Distinguish a CFA Charterholder?

Even for those who do not possess the CFA charter, the CFA® Institute's (CFAI) one-of-a-kind code of ethics and standards of professional conduct may be seen as a benchmark to which all financial professionals should strive and serve as a model to follow. A significant portion of the CFA exams are dedicated to Ethics and Standards, which provide an opportunity to prove your comprehension by demonstrating how you would safeguard your organization and customers from potential financial loss.

All members of the CFAI, as well as candidates striving for the CFA designation, are required to adhere to the Code and Standards, and are strongly urged to inform their employers of this duty. In the event of a violation, the CFAI has the right to implement disciplinary measures, including removal of the individual's authority to use the CFA designation, termination of their membership in the CFAI or their candidacy in the CFA Program.

Frequently Asked Questions

Does earning the CFA charter guarantee a high-paying job?

No, while the CFA designation can enhance your professional credentials and increase your marketability, it does not guarantee a high-paying job on its own. However, earning the CFA (Chartered Financial Analyst) charter is a prestigious and highly recognized achievement within the finance industry. Many employers value the CFA designation and consider it when making hiring decisions. However, job prospects and compensation depend on various factors, including market conditions, industry demand, your experience level, and the specific roles and responsibilities you undertake. While the CFA charter can provide a competitive edge, it’s crucial to combine it with relevant work experience, networking, and a strong track record to increase your chances of securing a high-paying job.

How does the CFA charter impact salary potential?

The CFA charter can enhance salary potential by demonstrating expertise and dedication to the field. It is often associated with higher compensation, but individual circumstances and negotiation skills also play a significant role. It’s important to note that salary potential is influenced by various factors, including market conditions, industry demand, geographic location, your level of experience, and the specific roles and responsibilities you undertake. While the CFA charter can enhance your earning potential, it is crucial to combine it with relevant work experience, a strong track record, and continuous professional development to maximize your salary potential within the finance industry.

Can the CFA charter help professionals transition to different finance sectors?

Yes. The CFA charter is beneficial for professionals transitioning to different sectors within finance. Here’s how it helps:

- Broadens Financial Knowledge

- Provides Credibility and Marketability

- Builds Transferable Skills

- Provide Networking Opportunities

- Enables career Flexibility

Note: Gaining practical experience and industry-specific knowledge is important to complement the benefits of the CFA charter. Stay updated, expand skills, and seek hands-on experience in the target sector.

Are there ongoing professional development requirements for CFA charterholders?

Yes. There are ongoing professional development requirements for CFA (Chartered Financial Analyst) charterholders. CFAI, the governing body that awards the CFA charter, has established the Continuing Professional Development (CPD) program to ensure that charterholders maintain and enhance their professional competence throughout their careers. The CPD program aims to promote lifelong learning and ongoing professional development.

Here are the key aspects of the CPD program for CFA charterholders:

- Minimum CPD Hours: Charterholders need to complete a minimum number of CPD hours annually, typically around 20 hours.

- Acceptable CPD Activities: Activities like attending conferences, publishing research, teaching, and involvement in professional associations qualify for CPD credits.

- Self-Reporting: Charterholders must report their CPD activities and maintain records with supporting documentation.

- Random Audits: CFAI conducts random audits to verify compliance with CPD requirements.

- Professional Conduct: Adhering to ethical principles and professional standards is vital for maintaining the CFA charter.

Please refer to official guidelines or consult local CFA Society for specific details and updates.

Can the CFA charter help in advancing to leadership positions?

Yes. The CFA charter can certainly help in advancing to leadership positions within the finance industry. While technical knowledge and experience are crucial for leadership roles, the CFA charter offers several advantages that can contribute to career progression and increased opportunities for leadership. Leadership roles often require a combination of technical expertise, strategic thinking, effective communication, and the ability to inspire and motivate teams. By leveraging the advantages of the CFA charter and continuously developing your leadership skills, you can enhance your prospects for advancing to leadership positions within the finance industry.

How does the CFA charter contribute to professional credibility?

Overall, the CFA charter contributes to professional credibility through its rigorous education and examination process, global recognition, adherence to ethical standards, practical knowledge, ongoing professional development, and membership in a respected professional network. Employers, clients, and industry stakeholders recognize the dedication, competence, and integrity associated with the CFA charter, which enhances the credibility and marketability of those who hold it.

Are CFA charterholders in demand in today's job market?

Yes. CFA charterholders are highly sought after in today’s job market due to their expertise, global recognition, commitment to professionalism and ethics, strong skill set, and professional connections. They possess in-depth knowledge in various finance areas and practical skills, making them valuable assets to employers. The rigorous CFA program’s global recognition enhances their marketability, while their commitment to ethical conduct and professionalism is highly valued. Charterholders’ well-rounded skill set includes financial analysis, investment decision-making, risk management, and communication skills, which are in high demand. Building a professional network through the CFA program provides additional advantages in terms of job referrals, mentorship, and access to job opportunities. Overall, the demand for CFA charterholders remains consistently strong in the job market.