The CFA exam is considered one of the hardest professional examinations in the world. Candidates often spend about 300 hours preparing for each of the exam’s 3 levels, and pass rates still range between 40% and 55%. Let’s look at scoring information for each level to help you set realistic preparation goals.

CFA Exam Pass Rates

The CFA Institute (CFAI) publishes pass rates from 1963 to now, providing finance professionals with essential insights into the exam’s rigor, legacy, and curriculum changes. Over the past 10 years (2016–2025), the average pass rate across all CFA exam levels is 44% — 41%, 45%, and 51% for Levels 1, 2, and 3, respectively.

| Level I | Level II | Level III | Total | |

|---|---|---|---|---|

| Candidates | 1,079,110 | 481,781 | 296,186 | 1,815,322 |

| Pass Rate | 41% | 45% | 51% | 44% |

CFA Level 1 Pass Rates

The CFA Level 1 pass rate in 2025 is 44%. Level 1 almost always has the lowest pass rate because it’s the most frequently taken and covers many topics. Because it’s the entry point, candidates aren’t as familiar with the exam’s difficulty.

| Testing Period | Candidates | Pass Rate |

|---|---|---|

| 2025 Total | 97,019 | 44.0% |

| February | 19,848 | 45.0% |

| May | 24,227 | 45.0% |

| August | 26,192 | 43.0% |

| November | 26,752 | 43.0% |

| 2024 Total | 89,389 | 44.1% |

| February | 16,932 | 43.8% |

| May | 21,116 | 45.8% |

| August | 24,937 | 44.3% |

| November | 26,404 | 42.8% |

| 2023 Total | 92,553 | 37.1% |

| February | 16,959 | 38.0% |

| May | 23,352 | 38.7% |

| August | 23,289 | 37.4% |

| November | 28,953 | 34.9% |

| 2022 Total | 82,435 | 36.5% |

| February | 18,992 | 35.8% |

| May | 19,403 | 37.7% |

| August | 19,103 | 36.8% |

| November | 24,937 | 35.8% |

CFA Level 2 Pass Rates

The CFA Level 2 pass rate in 2025 is 46.6%. Level 2 scores are usually better than Level 1 scores because the exam asks candidates to apply their knowledge from Level 1. However, it’s still a very difficult exam.

| Testing Period | Candidates | Pass Rate |

|---|---|---|

| 2025 Total | 39,901 | 46.6% |

| May | 15,000 | 54.0% |

| August | 9,898 | 44.0% |

| November | 15,003 | 42.0% |

| 2024 Total | 36,772 | 48.6% |

| May | 14,304 | 58.6% |

| August | 8,879 | 46.9% |

| November | 13,589 | 39.2% |

| 2023 Total | 39,554 | 47.2% |

| May | 15,895 | 52.2% |

| August | 9,074 | 44.1% |

| November | 14,585 | 43.7% |

| 2022 Total | 39,620 | 42.5% |

| February | 11,699 | 43.9% |

| August | 15,608 | 40.5% |

| November | 12,313 | 43.7% |

CFA Level 3 Pass Rates

The CFA Level 3 pass rate in 2025 is 49.5%. Although Level 3 scores are usually higher than Levels 1 and 2, due to greater candidate experience, it is still a challenging exam.

| Testing Period | Candidates | Pass Rate |

|---|---|---|

| 2025 Total | 25,669 | 49.5% |

| February | 11,131 | 49% |

| August | 14,538 | 50% |

| 2024 Total | 30,566 | 48.5% |

| February | 13,619 | 49.4% |

| August | 16,947 | 47.7% |

| 2023 Total | 30,893 | 47.5% |

| February | 14,858 | 47.8% |

| August | 16,035 | 47.3% |

| 2022 Total | 22,760 | 48.7% |

| May | 12,384 | 48.8% |

| August | 10,376 | 48.5% |

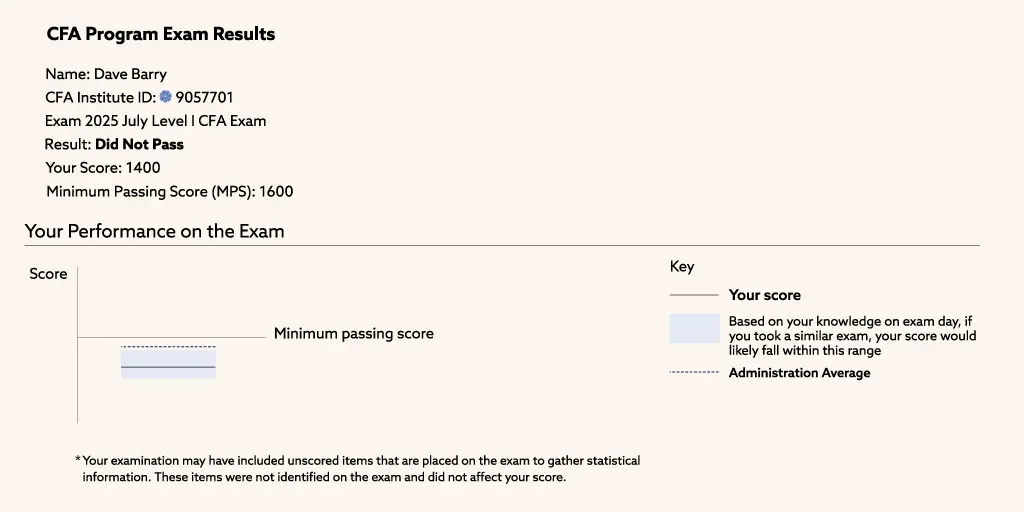

Understanding Your CFA Exam Results

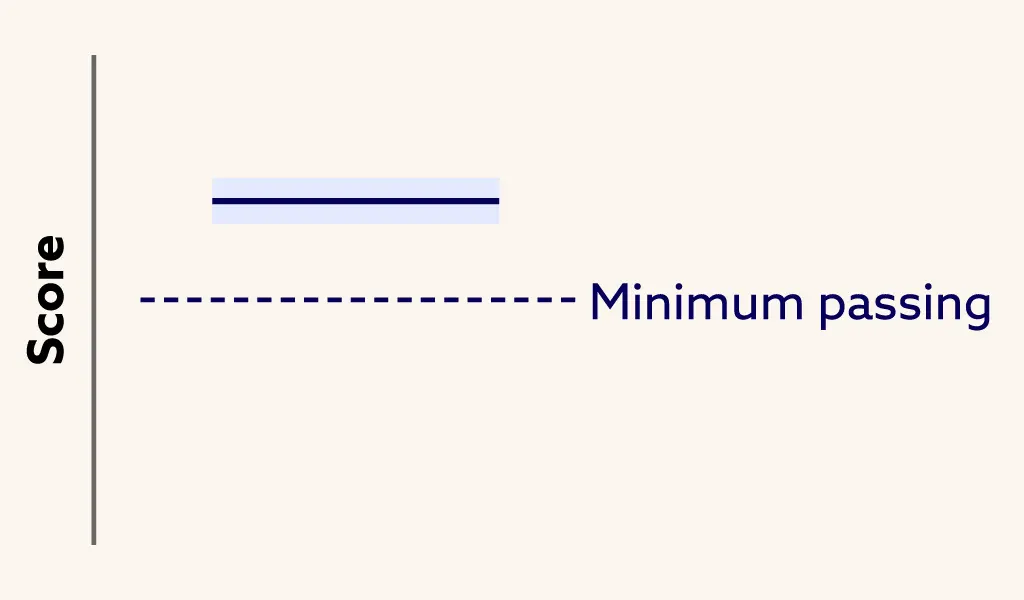

The CFA exam is a pass/fail assessment where candidates must meet the Minimum Passing Standard (MPS) for their level to advance in the exam sequence. While the MPS historically changed with every administration and was not disclosed, the current reporting system provides candidates with significantly more transparency: the official score report now includes both a scaled score and the specific Minimum Passing Standard (MPS) for that exam administration.

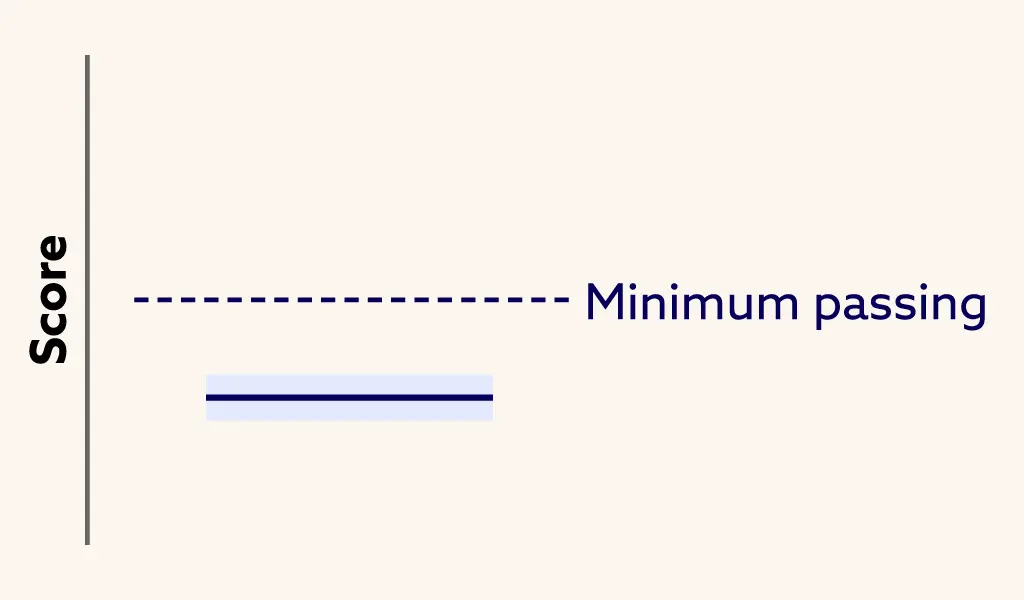

Scoring above the MPS shows you would have performed well across exam forms and have a strong grasp of the material.

Scoring below the MPS shows you would have performed poorly across exam forms and need to spend more time studying.

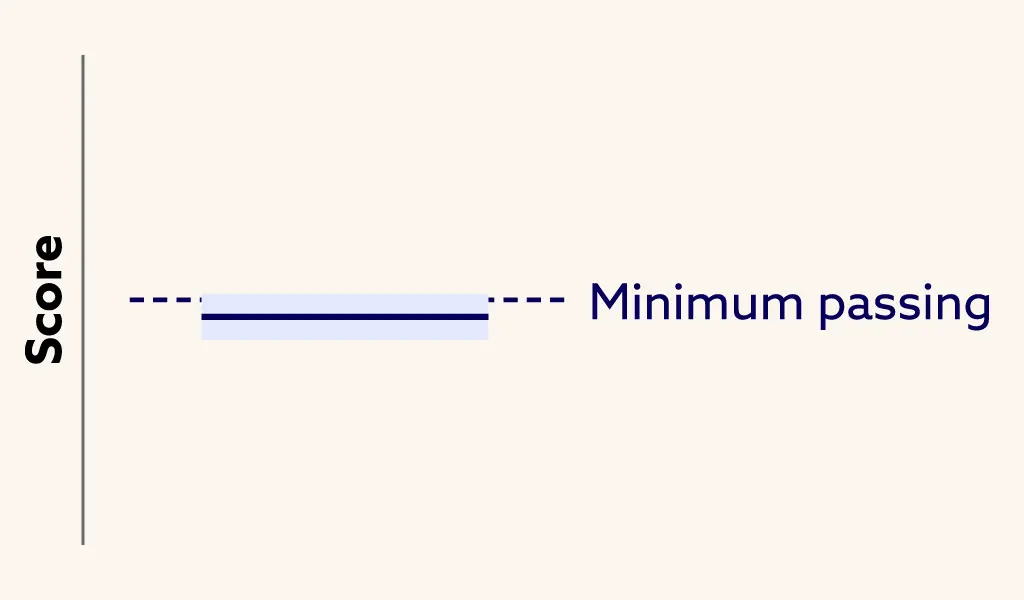

Overlapping MPS

If your confidence interval overlaps with the MPS, it’s possible you could have passed or failed. Study more, regardless.

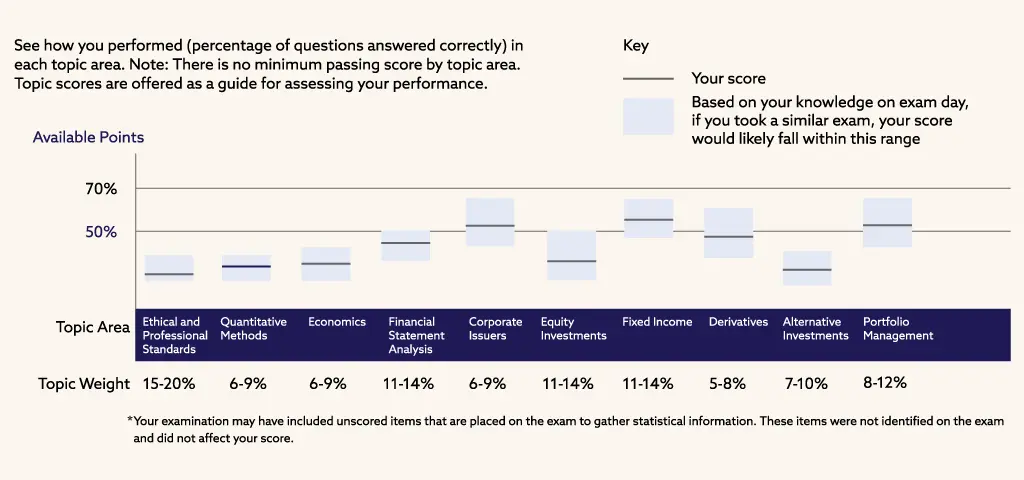

Your score report will also contain a breakdown of your performance in each of your exam’s topic areas. Whether you pass or fail, use it to strengthen your understanding of important finance topics.

How the CFA Exam Is Scored

The CFAI Board of Governors decides the MPS for the CFA exams using standard setting, which involves a range determined by psychometric principles. The MPS by level are as follows:

- CFA Level 1 MPS: 1,600

- CFA Level 2 MPS: 2,600

- CFA Level 3 MPS: 3,600

Each level is scored on a 900-point scale — 1,000 to 1,900 for Level 1, 2,000 to 2,900 for Level 2, and 3,000 to 3,900 for Level 3. Equating is used to make sure the MPS is consistent across exam forms. While pass rates may fluctuate, the Board’s goal is to maintain a consistent competency standard each year. This upholds the integrity of the charter and ensures fairness for all candidates, regardless of when they took their exams.

Once your exam is submitted, it enters a rigorous grading process focused on quality control. Machines grade multiple choice and item set questions, while CFA charterholders from around the world review essays. Multiple checks and procedures are followed to ensure grading is fair and consistent.

Frequently Asked Questions (FAQs)

When are CFA exam results released?

You will receive an email from the CFAI within 5 to 8 weeks after the close of your exam window. You can access your results by signing in to the CFAI website.

How long do CFA exam results last?

Your CFA exam results do not expire, and there is no limit to the amount of time you have to complete the CFA Program. Your results are available for about 1 year after the test date. After this date, you may prove your status with the CFA Program by logging in to the CFAI website and generating a verification letter.

How many CFA exam attempts do I get?

Effective since 2021, each exam level can be taken twice yearly, with a maximum of 6 attempts per level.

What is the CFA exam minimum passing score (MPS)?

The CFAI released a sample chart for February 2025 with the following MPS values: 1,600 on Level 1, 2,600 on Level 2, and 3,600 on Level 3. However, minimum passing scores have historically been withheld. The MPS maintains a consistent standard as the exam format changes over time.

Are all questions scored on the CFA exam?

The CFA exam scoring process is not as straightforward as simply receiving a numerical score. After a multi-step process, a minimum passing score (MPS) is determined and applied to all graded exams. In recent years, it’s been estimated that Levels 1 and 2 have had a MPS of close to 70%, while Level 3 has had a MPS of close to 60%.

Why are CFA pass rates so low?

The CFA exam’s low pass rates reflect its rigorous curriculum and heavy analytical focus. Many candidates underestimate the time needed for comprehensive prep. Structured study tools, such as UWorld’s CFA Exam Prep course, help candidates close the gap to the MPS through targeted practice, in-depth analytics, and exam-style learning.