CFA Level 3 Question Bank

Make the CFA Level 3 Exam Feel Like Practice

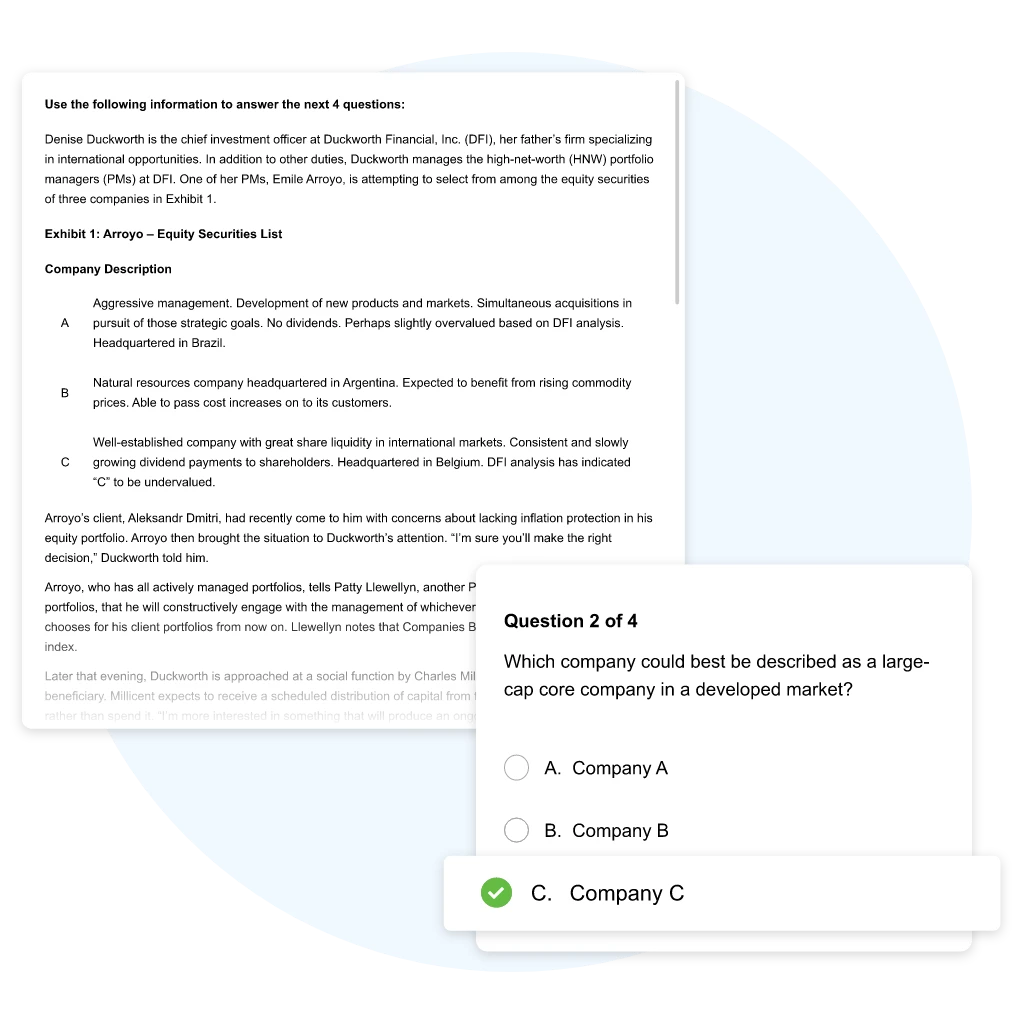

Master Concepts Faster

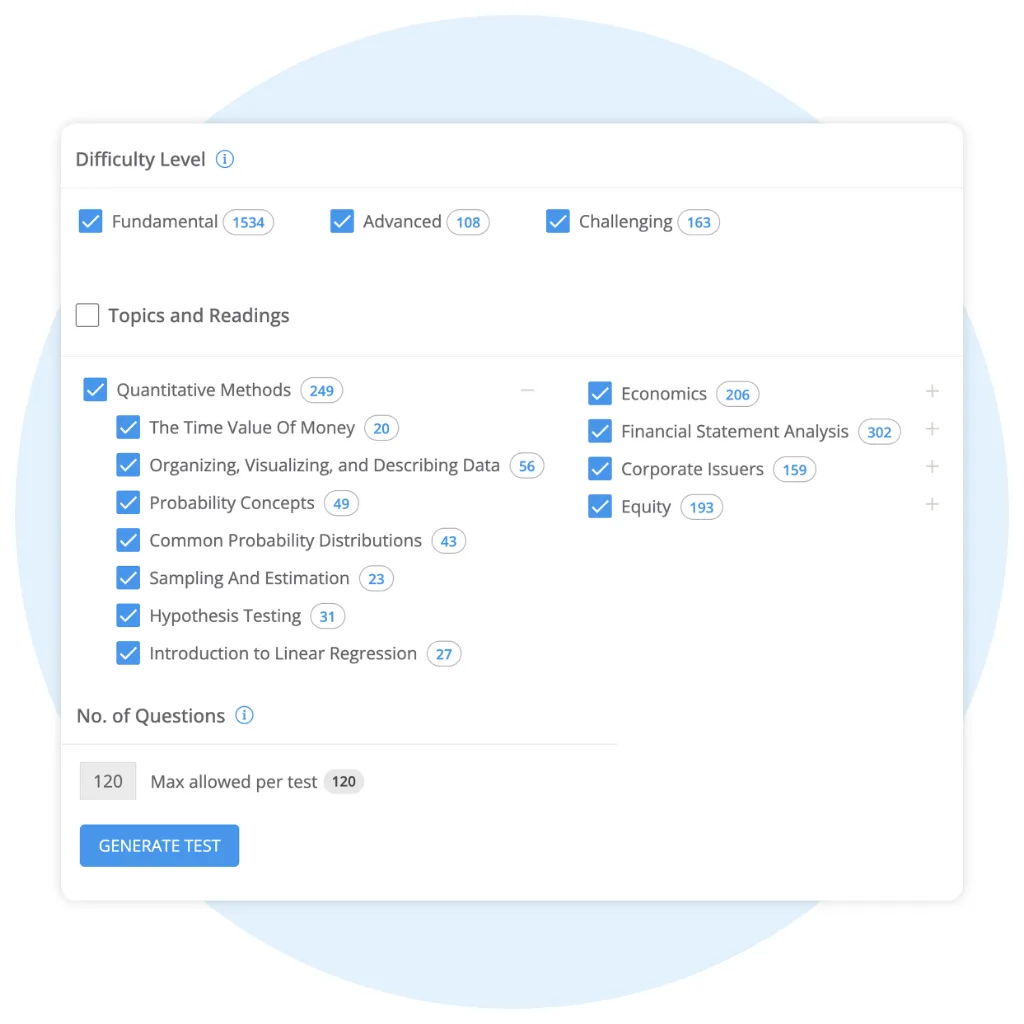

Quiz Smarter, Not Harder

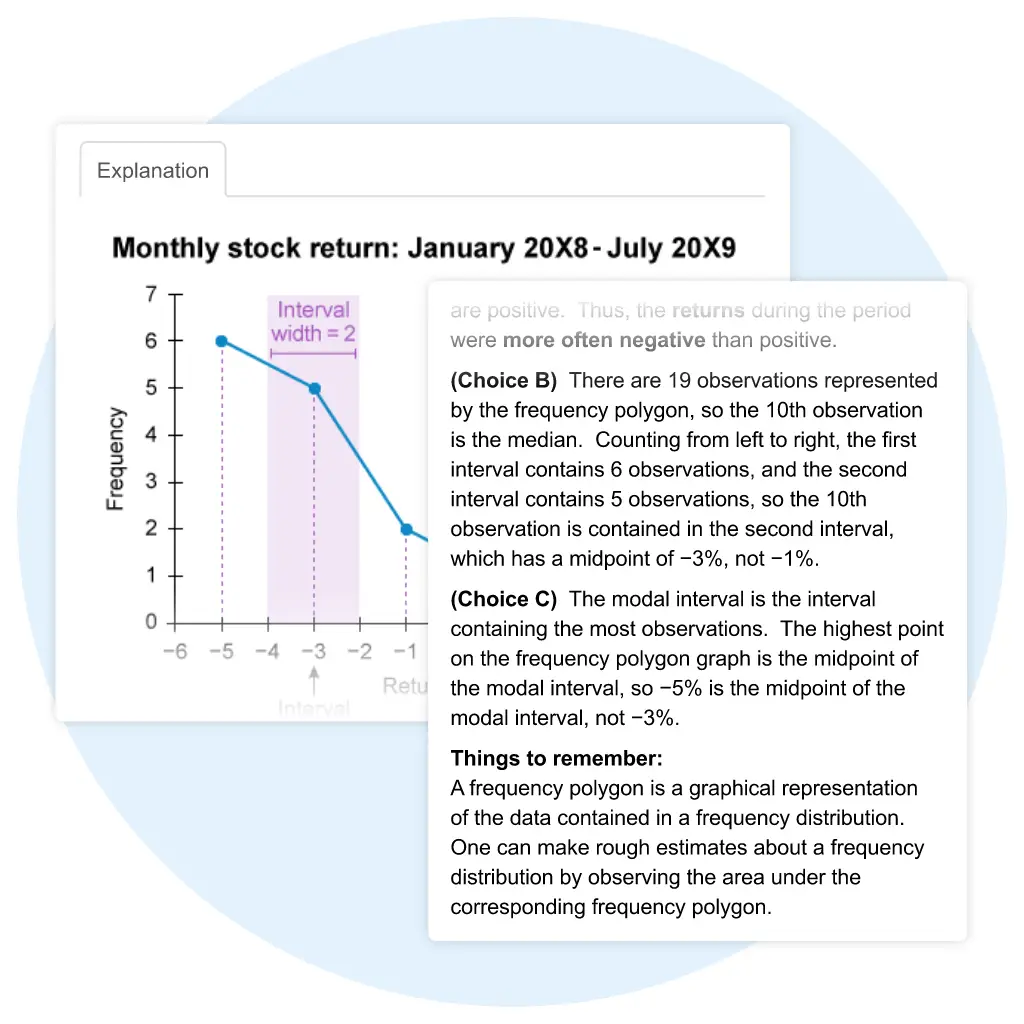

Learn the “Why” Behind Every Answer

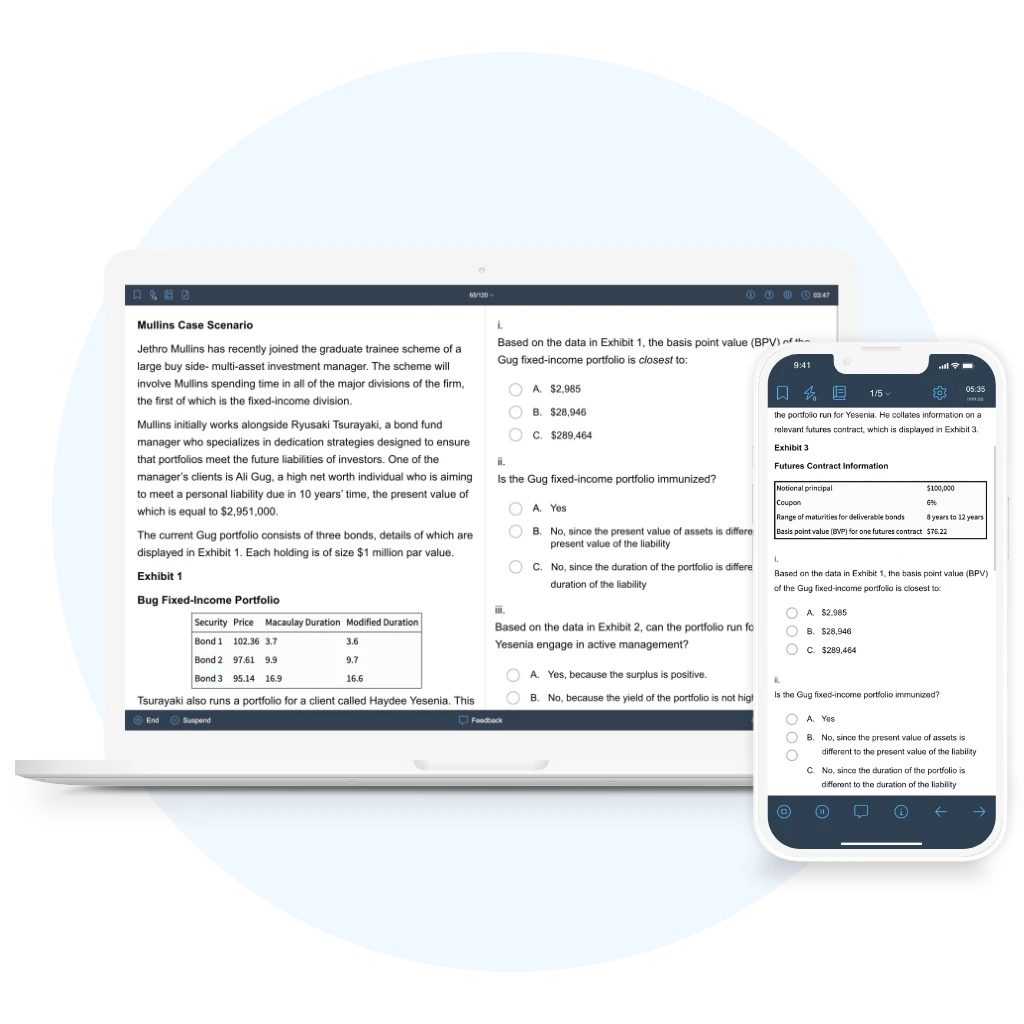

Simulate Exam

Conditions

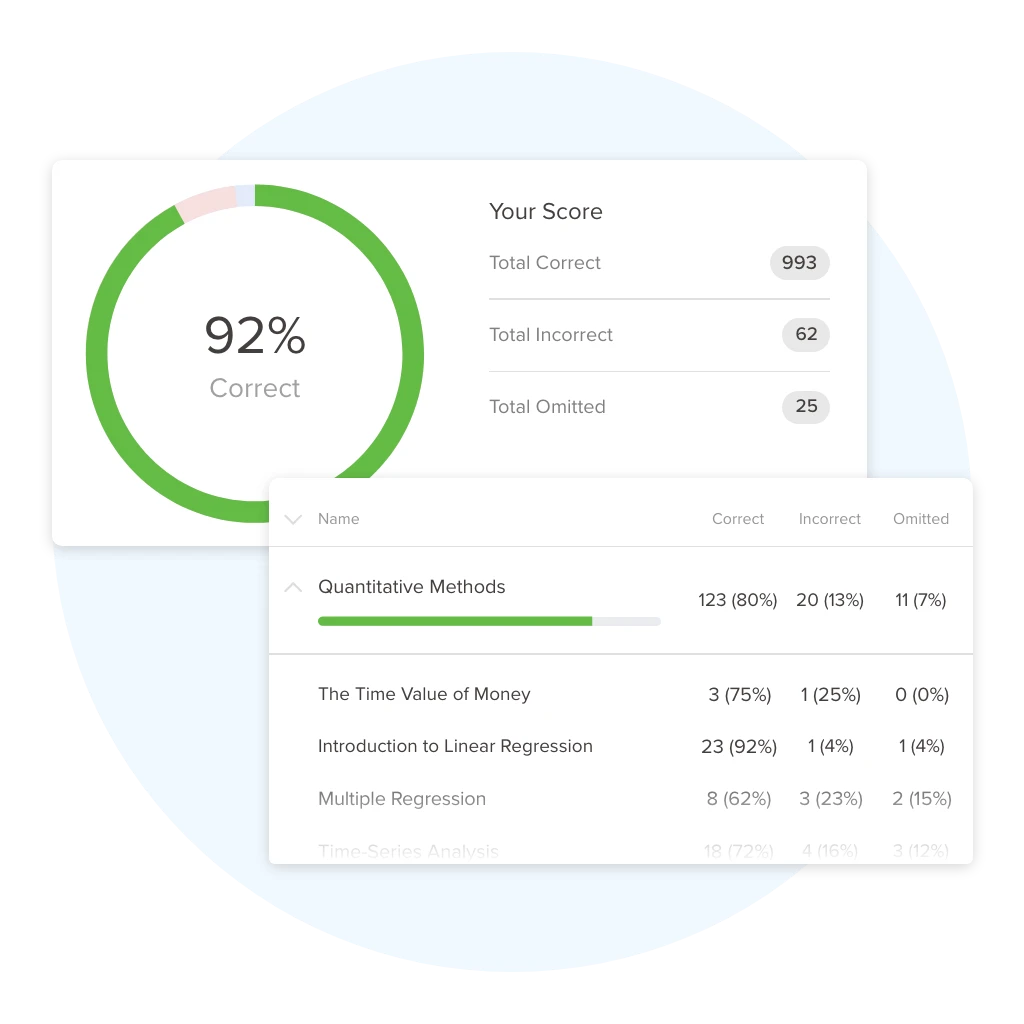

Turn Weaknesses into Strengths

Replicate the Exam Environment

Score Higher on Level 3 with UWorld’s Quality Learning Tools

Use Up-to-Date CFA QBank Aligned to the Exam

Simplify Your Learning

Multiple Ways to Study, Multiple Ways to Save

Whether you’re searching for a complete CFA Level 1 course with unlimited access or a supplement, we have you covered.

Explore our free trial and product availability

Explore our free trial and product availability.

Hear From Our Past CFA Candidates

High quality questions with extremely high quality explanations and answers. The effort by the UWorld team to create useful diagrams that distill content down to only what is necessary has surpassed most other prep material that I've seen.…"

The best test-bank I've found! The questions are complex. And the format mimics the exam; excellent explanations for each answer option. Application-based questions are very nuanced and further help strengthen the underlying concept. My favorite, the QBank itself, can help one learn the whole curriculum thoroughly just through practice questions."

I have used other well-known CFA providers and found the questions provided by UWorld to be very targeted in honing on the highly essential practice problems needed for success. I'm also a big fan of the available option to create flashcards; it's been hugely beneficial so far."