UWorld CFA® Level 1 Mock Exams

Know Exactly What to Expect

What if You Could Take the CFA Exam before You Take the CFA Exam?

Unique Questions

CFA Institute Approved

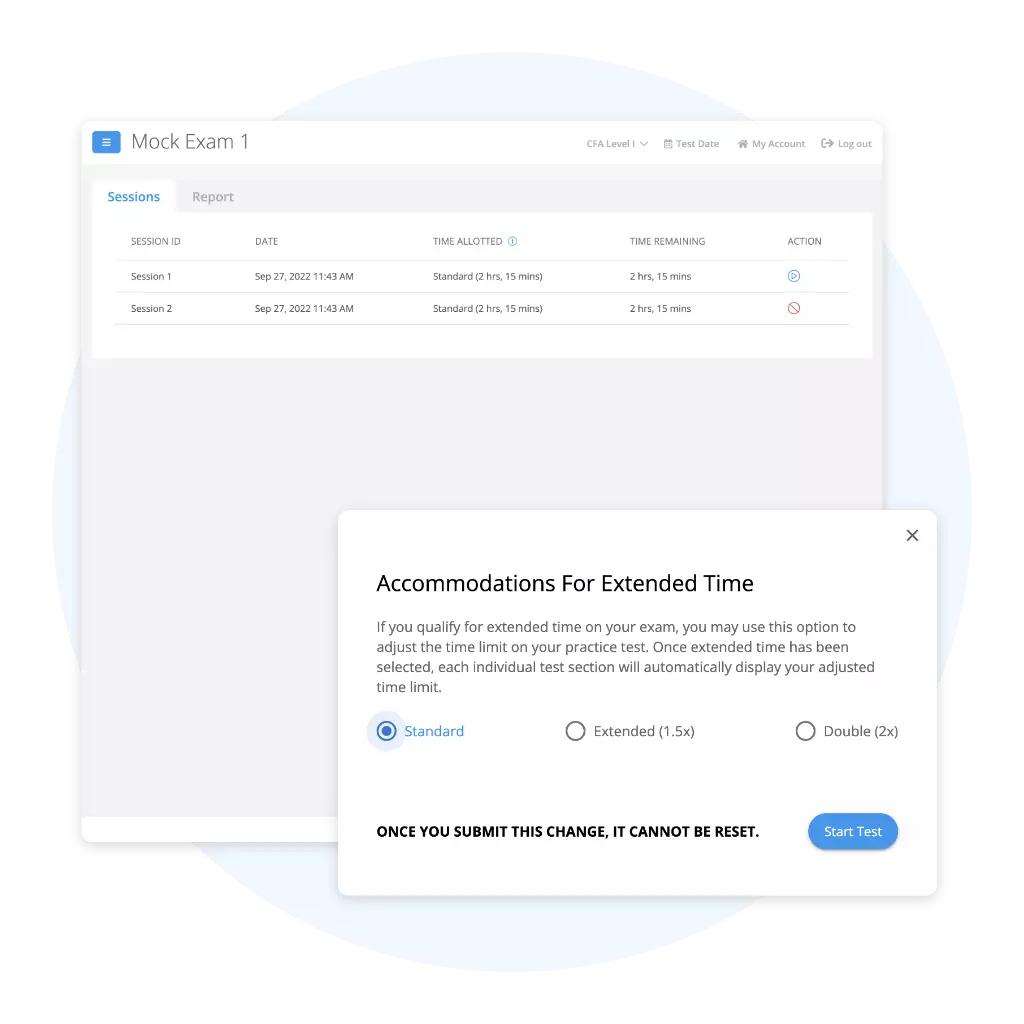

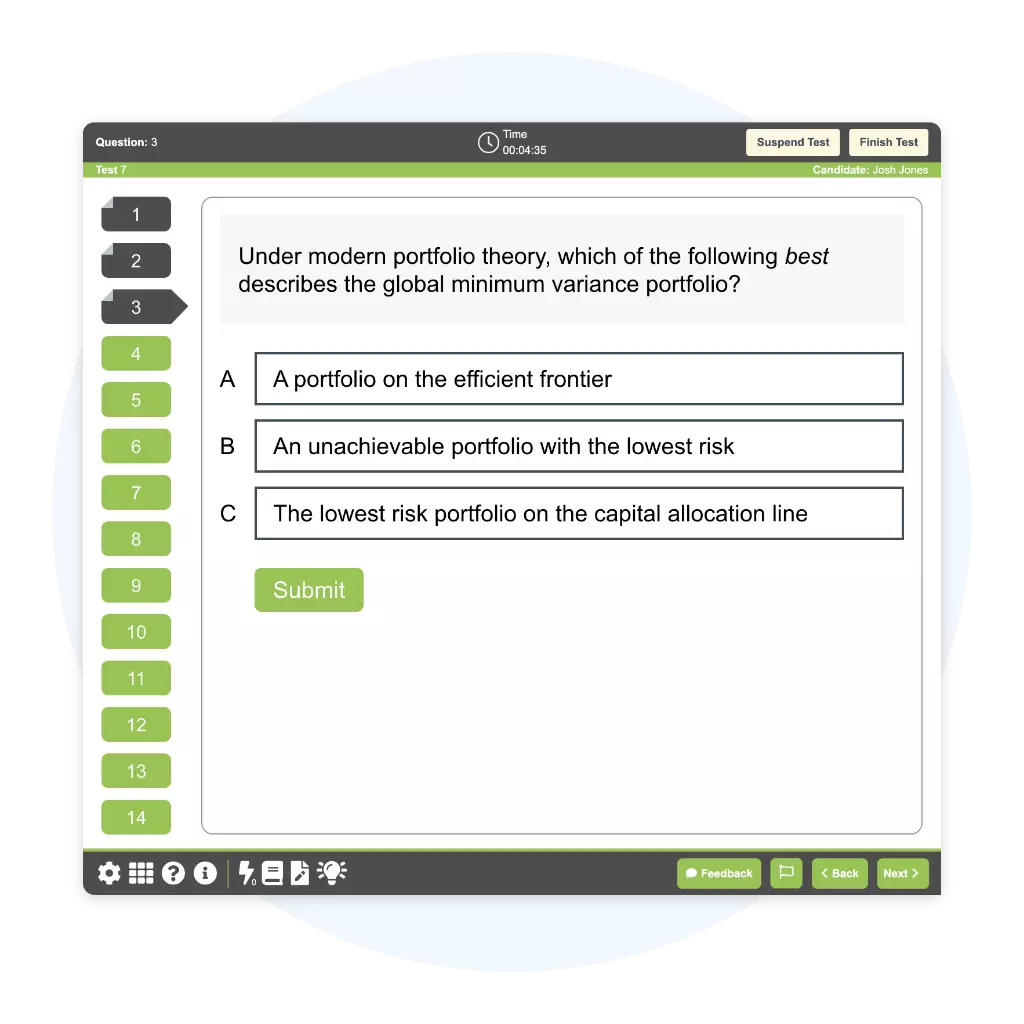

Exam-Day Interface

Timed

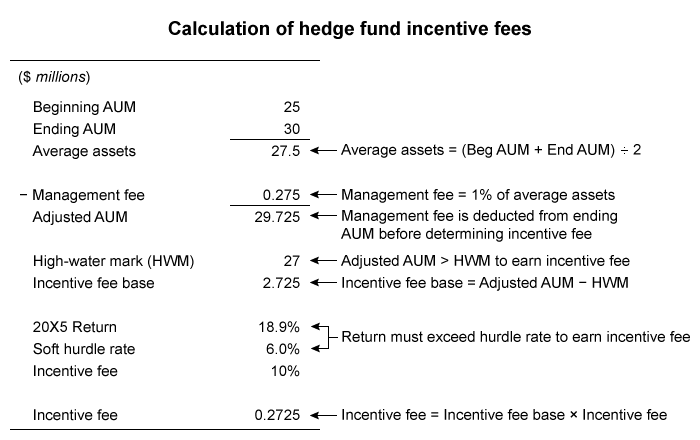

Exam-Level

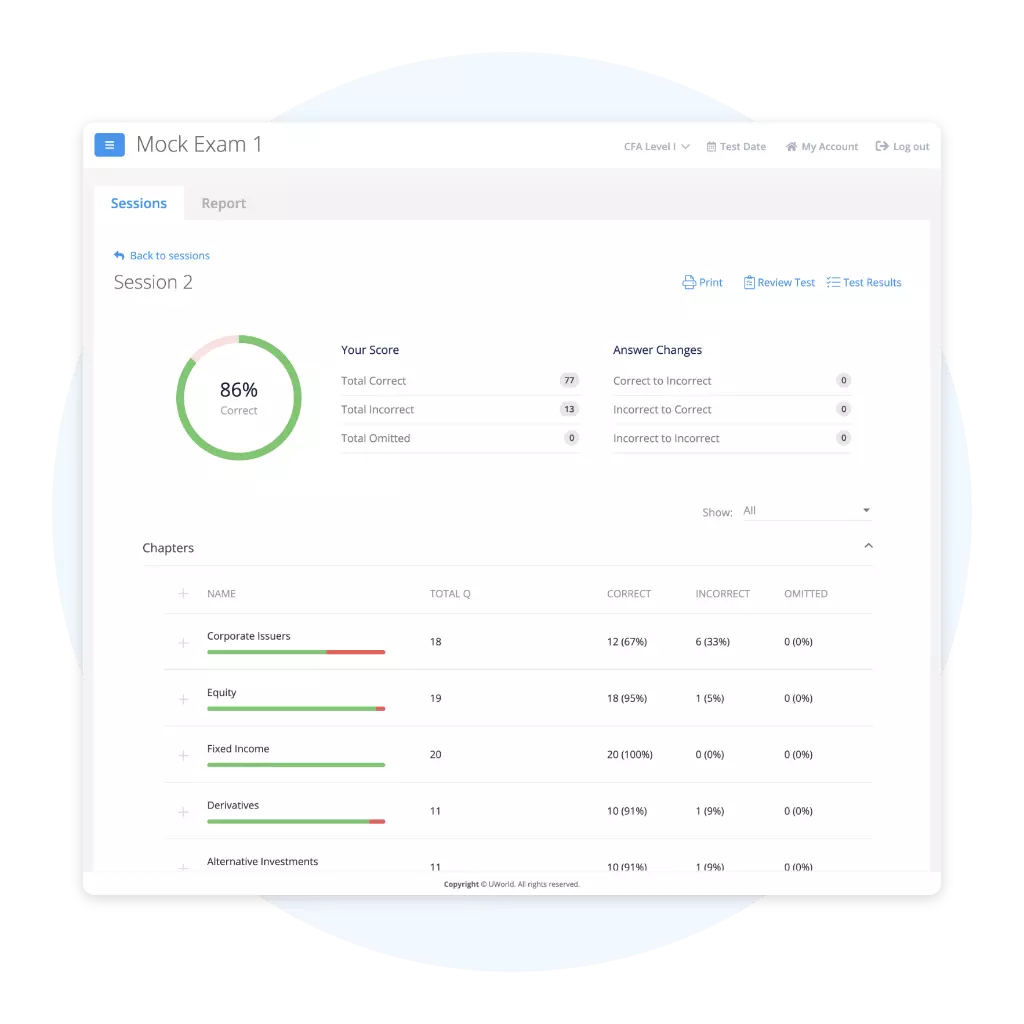

Tracked

Make the Actual CFA Exam Feel Like Practice

CFA Candidate Success Stories

After attempting the mocks on UWorld, which are very difficult, I gained confidence and worked through the loopholes in my knowledge. Great! The explanations are very friendly, and the tools available are useful and time-saving."

The explanations on answers are incredibly detailed, unlike the official curriculum. I am currently using two other providers besides this one. I can say the questions on the mock exam and practice questions have the highest quality. UWorld will be a central part of my study process in future."

The practice questions test your limit. The rigor and attention to detail are top-notch. The explanations are comprehensive, and I feel more confident with every question I tackle. Best practice mocks one could ask for that hit all parts of the exam yet have appropriate difficulty!"

Jumpstart Your CFA® Exam Prep Today

Invest in yourself today. Profit tomorrow.

Mock Exams

Study Guides

Best Value

Full Course

Jumpstart Your CFA® Exam Prep Today

Invest in yourself today. Profit tomorrow.

Mock Exams

Study Guides

Best Value

Full Course