Whether you're interested in auditing and taxation or the fast-paced world of investments and portfolio management, this guide will help you determine which qualification fits your vision for the future.

Overview

The CFA is a globally recognized certification, focusing on investment management, financial analysis, and portfolio management. If you're interested in the stock market, investment banking, or working with international finance firms, the CFA is an ideal fit. Offered by the CFA Institute, this program is ideal for professionals who want to work in India or globally within the finance sector.

The CA is a well-established qualification in India, with a strong focus on taxation, auditing, and financial reporting. If you aspire to work in audit firms or want to specialize in taxation, CA is the path for you. Conducted by the Institute of Chartered Accountants of India (ICAI), this certification is essential if you're aiming to become a certified auditor in India. The role offers stability and is well-respected in the Indian finance sector.

Here’s a quick comparison to give you the basics:

| Attribute | CFA | CA |

|---|---|---|

| Levels | 3 | 3 |

| Requirements | Bachelor’s degree or work experience | 12th Pass + CA Foundation |

| Cost | ₹2,14,279 to ₹2,89,9907 | ₹1,85,000 (approximate) |

| Focus Areas | Investments, Portfolio Management | Auditing, Taxation, Accounting |

| Completion Time | 3-5 years | 5 years |

| Pass Rate | 30-50% | 60.7% |

| Career Paths | Portfolio Manager, Analyst, Consultant | Auditing, Accounting, Taxation |

| Average Salary | ₹12-14 lakh per annum | ₹6-9 lakh per annum |

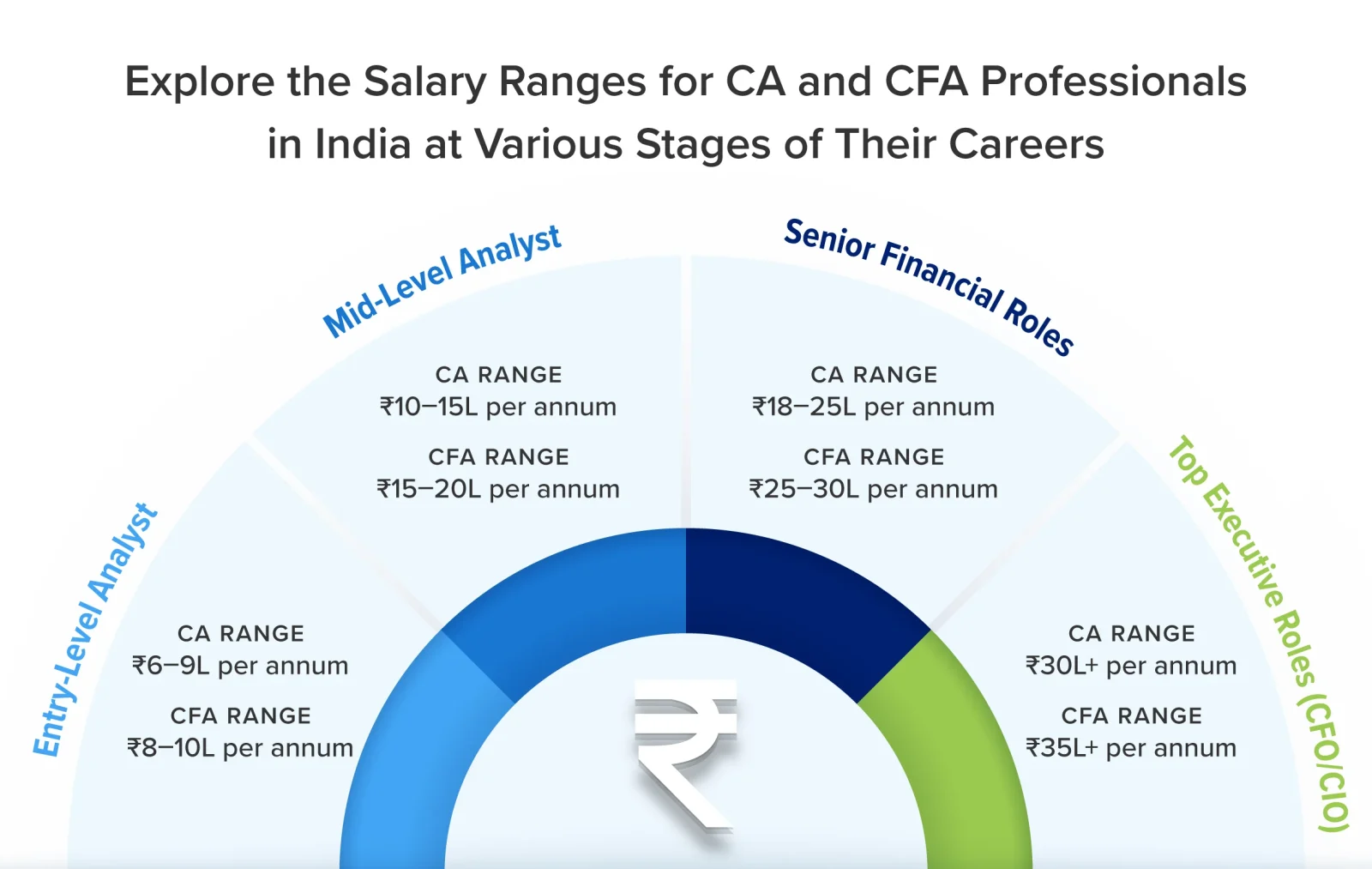

CFA vs. CA Salaries

Salary is always a big factor when choosing a career path, and both the CFA and CA offer earning potential. However, the roles, responsibilities, and industries they serve differ, which leads to varying salary ranges.

| Job Role | CFA Salary Range | CA Salary Range |

|---|---|---|

| Entry-Level Analyst | ₹8-10 lakh per annum | ₹6-9 lakh per annum |

| Mid-Level Manager | ₹15-20 lakh per annum | ₹10-15 lakh per annum |

| Senior Financial Roles | ₹25-30 lakh per annum | ₹18-25 lakh per annum |

| Top Executive Roles | ₹35+ lakh per annum | ₹30+ lakh per annum |

While CFAs often begin their careers as analysts in investment management firms, banks, or consulting companies, CAs usually start in roles related to taxation, auditing, and internal finance. Both paths offer plenty of room for growth, but CFA professionals, especially those working in investment banking or portfolio management, tend to command higher salaries, particularly in international markets.

Common Career Paths

The CFA and CA career paths can look quite different. Here are the typical roles you can expect to pursue:

CFA Career Paths in India

- Investment Analyst (₹8-12 lakh per annum): Conducts research and provides insights to portfolio managers.

- Portfolio Manager (₹15-25 lakh per annum): Manages large investment portfolios and makes crucial decisions for clients.

- Wealth Manager (₹10-20 lakh per annum): Helps high-net-worth clients manage their finances and investments.

- Chief Investment Officer (₹30+ lakh per annum): Oversees a firm’s entire investment strategy at banks or mutual funds.

CA Career Paths in India

- Audit Associate (₹6-9 lakh per annum): Audits financial statements for corporations and ensures compliance.

- Tax Consultant (₹8-12 lakh per annum): Provides advice on tax planning and corporate tax strategies.

- Forensic Auditor (₹12-20 lakh per annum): Investigates financial fraud and ensures governance.

- Chief Financial Officer (CFO) (₹30+ lakh per annum): Manages the entire financial operations of a company.

Pros and Cons

Both the CFA and CA certifications have pros and cons, and your decision should be based on what suits your strengths and interests.

Pros and Cons of CFA

| Pros | Cons |

| Globally recognized certification | Higher exam fees |

| Focuses on investment management | Lower pass rates (30-50%) |

| Versatile career options in finance | Requires deep knowledge of global finance |

| Flexible study schedule | Can be more competitive internationally |

Pros and Cons of CA

| Pros | Cons |

|---|---|

| Essential for careers in auditing and taxation | Longer duration to complete (up to 5 years) |

| Higher pass rates in India (60%+) | Limited international recognition |

| Lower cost compared to CFA | Mainly focused on accounting, taxation |

Which Path Should You Choose?

The decision between CFA and CA largely depends on your career aspirations and where you see yourself in the future.

If you’re passionate about investment banking and portfolio management and you want to work with global financial markets, the CFA designation might be the better fit. Its international recognition opens doors not just in India but across the globe.

If you enjoy auditing, taxation, or working in a more structured corporate environment, CA could be the right choice. It offers a strong foundation and is highly respected in India.

Ultimately, both paths offer exciting and lucrative career opportunities, so it’s about finding the one that aligns with your interests and goals. Both CFA and CA qualifications will give you the skills to thrive in the ever-growing world of finance.