CFA® Exam Sample Questions & Practice Questions for Levels 1, 2 & 3

Not all CFA® practice questions are created equal. UWorld’s CFA exam-style sample questions reflect the latest CFA Institute LOS and exam format. Each includes detailed explanations and visuals to strengthen understanding across Levels 1, 2 & 3.

*No Credit card required

Practice Smarter with UWorld CFA® Sample Questions

Compare our Content with our competitors.

According to the Modigliani-Miller propositions (with taxes), if a company increases its debt level, its market value will most likely:

- decrease since the costs of financial distress are increasing.

- remain the same since the market value is unaffected by the capital structure.

- increase proportionally to the change in debt.

Explanation:

The Modigliani-Miller (MM) propositions assume perfect capital markets (ie, no arbitrage, no transaction or bankruptcy costs, and symmetric information) and assert that a company’s market value equals the present value of its future cash flows. Modigliani and Miller propose that, in the absence of taxes:

- A company’s capital structure does not affect its value (MM I without taxes); and

- A company’s cost of equity (re) is directly proportional to its debt-to-equity ratio (D/E), but WACC remains constant (MM II without taxes).

However, these propositions change when there are corporate taxes:

- The market value of a levered company is greater than the value of an unlevered but otherwise identical company; tax-exempt interest payments improve the levered company’s cash flows, increasing its value. The difference in value is the amount of the debt tax shield (tD), which is the product of a company’s tax rate (t) and value of debt (D) (MM I with taxes).

- A company’s re is directly proportional to D/E, adjusted by (1 − t). Greater leverage will increase the cost of equity, but at a slower pace due to taxes. The greater the tax rate (t), the slower the increase in re when D/E increases (MM II with taxes).

Therefore, with taxes, an increase in debt will proportionally increase a company’s value and reduce its WACC.

(Choice A) The MM propositions assume no cost of financial distress.

(Choice B) The market value would remain the same in the absence of taxes.

Things to remember:

The Modigliani-Miller (MM) propositions assume perfect capital markets (ie, no arbitrage, no transaction or bankruptcy costs, and symmetric information). When these propositions include corporate taxes, greater leverage will increase a company’s market value (MM I) and reduce its WACC (MM II).

If a professional organization has standards of conduct in addition to its code of ethics, the purpose of the standards is most likely to describe:

- shared principles.

- laws and regulations.

- acceptable behaviors.

Explanation:

| Instruments for compliance with professional ethics | ||

|---|---|---|

| Instrument | Owner | Describes |

| Code of ethics | Professional organization | Shared principles |

| Standards of conduct | Professional organization | Minimally acceptable behavior |

| Laws and regulations | Government | Legal limits of behavior |

A code of ethics is a professional organization’s statement of shared principles. Standards of conduct provide a guide to practicing the principles outlined in the code of ethics. Standards of conduct also clarify the minimally acceptable behaviors required to conform to the code of ethics. Although not addressed directly in standards of conduct, adherence to civil laws and regulations may be the minimally acceptable behavior in some cases.

Standards of conduct may be principle-based or rule-based. Principle-based standards are universally applicable to members of the profession and are based on the principles outlined in the code of ethics. Rule-based standards, while also relating to the principles in the code of ethics, are usually more narrowly applicable and specific to certain members or scenarios that may arise.

A code of ethics may or may not be accompanied by standards of conduct whereas standards of conduct exist only to enhance their associated code of ethics. CFA Institute has adopted both a code of ethics and standards of conduct (the “Code and Standards”); CFA charterholders and candidates are expected to know and comply with both.

(Choice A) Standards of conduct are used to describe minimally acceptable behaviors or practices, given the shared principles of the code of ethics. The code of ethics describes the shared principles.

(Choice B) Standards of conduct do not describe civil laws and regulations.

Things to remember:

Standards of conduct are used to clarify the minimally acceptable behaviors required to conform to the shared principles stated in a code of ethics; they do not address applicable civil laws and regulations.

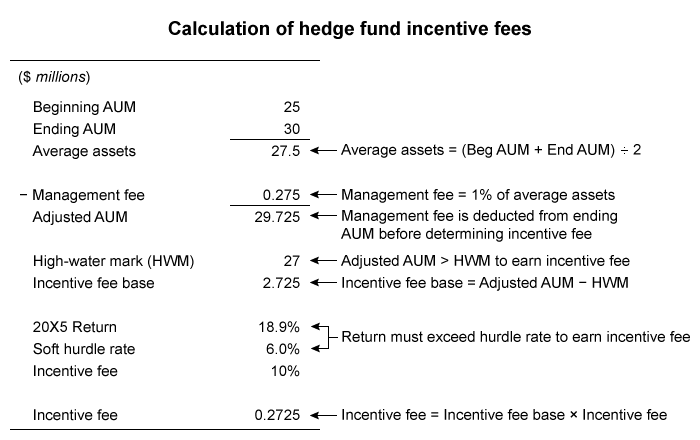

At the end of 20X4, a hedge fund had $25 million in assets under management (AUM). The fund has the following fee structure, high-water mark, and 20X5 results:

| Selected Data | |

| Management fee (average assets) | 1% |

| Incentive fee (net of management fee) | 10% |

| Soft hurdle rate | 6% |

| High-water mark (millions) | $27 |

| Year-end fund assets 20X5 (millions) | $30 |

Assuming no inflows or outflows, the incentive fee (in $) earned by this hedge fund for 20X5 is closest to:

- 109,000

- 272,500

- 300,000

Explanation:

Hedge funds charge a management fee and an incentive fee. The management fee is calculated as a percentage of the total value of the fund’s assets under management (AUM). It is assessed each year regardless of profitability.

The incentive fee is levied against the fund’s annual gains, subject to certain conditions. It is calculated either gross or net of the management fee. The net calculation subtracts the management fee from AUM to arrive at an adjusted AUM that is used to calculate the fund’s profits.

The high-water mark represents the value of AUM, net of fees, at any time during the fund’s existence. To earn an incentive fee, the fund must exceed the high-water mark, the base from which the fee is calculated.

The hurdle rate is the minimum profit that the fund must earn (usually annually) before it receives an incentive fee. The hurdle rate can either be “soft,” meaning that the incentive fee is calculated based on the entire profit, or “hard,” meaning that the incentive fee is based on only the excess profit above the hurdle rate.

In this scenario, the fund generated net returns in 20X5 of 18.9% ( = (29.725 – 25) / 25 ), above the soft hurdle rate of 6%, and eclipsed the high-water mark of $27 million. Therefore, the fund earned an incentive fee of 10% of profits, net of the management fee on average assets of $27,500,000:

0.10 × (29,725,000 − 27,000,000) = $272,500.

(Choice A) $109,000 is the result of incorrectly assuming a hard hurdle rate is in effect.

(Choice C) $300,000 is the incentive fee if management fees are not deducted.

Things to remember:

Hedge funds charge both a fixed management fee and a variable incentive fee. The incentive fee is contingent on whether the fund earns a profit and may be subject to a high-water mark and hurdle rate.

In the short run, a company maximizing profit in a market with perfect competition produces at a quantity that most likely results in:

- economic profits equal to zero.

- marginal revenue equal to marginal cost.

- market price greater than marginal revenue.

Explanation:

A firm operating under perfect competition maximizes economic profit by producing and selling at the quantity where marginal revenue (MR) equals marginal cost (MC). Cost in this context includes opportunity costs (eg, the owners’ required return from the business). Perfectly competitive firms can earn economic profits in the short run, but even if economic profits are zero or negative, a firm may be earning an accounting profit.

MR, the incremental revenue from selling one additional unit, depends on the firm’s demand curve. In the case of perfect competition, the demand curve for any individual firm is a horizontal line at the market equilibrium price, since demand is perfectly elastic. Therefore, market price equals MR at all quantities (Choice C).

MC, the incremental cost to produce one additional unit, depends on the firm’s cost structure. Producing at a quantity greater than where MR = MC means that the incremental cost for each unit exceeds the incremental revenue generated by that unit and the firm generates a loss on each additional unit sold. Producing at a lower quantity means that the firm forgoes economic profit (in the short run) since the additional revenue from a unit sold would exceed the cost of the unit.

(Choice A) Perfectly competitive firms can earn economic profits in the short run. However, in the long-run, the positive economic profits will attract new firms, which will increase supply/lower price until economic profit is zero.

Note: Although this question specifically addresses perfect competition, the condition that firms optimally produce when MR = MC applies to all market structures. It is likely that the exam will have questions on this topic.

Things to remember:

Under perfect competition, a firm maximizes short-run economic profit by producing and selling at the quantity where marginal revenue (MR) equals marginal cost (MC). Since there is perfectly elastic demand, price also equals MR for all quantities. Short-run, but not long-run, economic profits are possible. However, a firm may earn an accounting profit even if economic profits are zero or negative.

An analyst observes the following market data for one American put option:

| Selected Data | |

| (in CAD) | |

| Stock price | 48 |

| Strike price | 50 |

| Option premium | 4 |

This option’s moneyness is best described as:

- in the money.

- at the money.

- out of the money.

Explanation:

Moneyness refers to the relationship between an option’s strike price and the underlying stock price and is indicative of the option’s intrinsic value. An option trading at the money or out of the money has no intrinsic value. An option trading in the money has intrinsic value:

- For an in-the-money call option, the underlying stock price is greater than the strike price. This gives the call owner the right to buy the stock at a price lower than the market price, which in turn gives the option intrinsic value.

- For an in-the-money put option, the strike price is greater than the underlying stock price. This gives the put owner the right to sell the stock at a price higher than the market price, which in turn gives the option intrinsic value.

In this scenario, the put option’s underlying stock price is less than its strike price. Therefore, the option is trading in the money. Note that the option’s premium is irrelevant to determining the option’s intrinsic value; it would, however, be relevant to determining the option’s profit at exercise.

(Choice B) If the stock price equals the strike price, the option is trading at the money (ATM). At expiration, an ATM option is economically equivalent to owning the underlying asset.

(Choice C) For a call option, if the stock price is less than the strike price, the option is trading out of the money (OTM) and has no intrinsic value. The same is true for a put option if the stock price is greater than the strike price.

Things to remember:

Moneyness refers to the relationship between an option’s strike price and the underlying stock price. If the stock price equals the strike price, the option is trading at the money. For a call (put) option, if the stock price is greater (less) than the strike price, the option is trading in the money. For a call (put) option, if the stock price is less (greater) than the strike price, the option is trading out of the money.

A multivariate distribution:

- specifies the probabilities associated with groups of random variables.

- gives multiple probabilities for the same outcome.

- applies only to binomial distributions.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A multivariate distribution specifies the probabilities for a group of related random variables.

The following data points are observed returns.

14.4%, 17.0%, 19.0%, 22.5%, 4.2%, 6.8%, 7.0%, 10.9%, 11.6%, What return lies at the 70th percentile (70% of returns lie below this return)?

- 19.0%

- 17.0%

- 14.4%.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. With 9 observations, the location of the 70th percentile is (9 + 1)(70 / 100) = 7. The seventh observation in ascending order is 17.0%.

The average annual return over 20 years for a sector of mutual funds, calculated for the population of funds in that sector that have 20 years of performance history, is most likely to:

- understate returns for the fund sector.

- overstate returns for the fund sector.

- fairly state returns for the fund sector.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A sample suffers from survivorship bias if only surviving funds are captured in the data. Funds that cease to exist (due to poor performance) are excluded. This results in an average that overstates the annual return an investor in the sector could actually have expected to earn over the period.

Which of the following statements about a normal distribution is least accurate?

- A normal distribution has excess kurtosis of three.

- The mean and variance completely define a normal distribution.

- Approximately 68% of the observations lie within +/- 1 standard deviation of the mean.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. Even though normal curves have different sizes, they all have identical shape characteristics. The kurtosis for all normal distributions is three; an excess kurtosis of three would indicate a leptokurtic distribution. Both remaining choices are true.

The average return on small stocks over the period 1926-1997 was 17.7%, and the standard deviation of the sample was 33.9%. Assuming returns are normally distributed, the 95% confidence interval for the return on small stocks next year is:

- 16.8% to 18.6%.

- –48.7% to 84.1%.

- –16.2% to 51.6%.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A 95% confidence interval is ± 1.96 standard deviations from the mean, so 0.177 ± 1.96(0.339) = (–48.7%, 84.1%).

Compare our Content with our competitors.

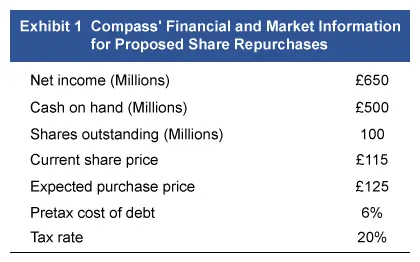

Passage

Compass Engineering’s board of directors is deciding between cash dividends or a share repurchase program as a method to begin returning cash to shareholders. Liam Fischer, a member of the board, states that both cash dividends and share repurchases have certain advantages that should be considered:

| Advantage 1: | Share repurchases tend to be more flexible. Although dividends can be raised, lowered, or suspended, they appear to create an expectation among investors that the distribution will continue in the future. Share repurchases do not seem to create the same expectation. |

| Advantage 2: | If the tax rates for capital gains and dividends are the same, and the information content is the same, then shareholders’ wealth will be greater with cash dividends since all shareholders receive cash. |

Alicia Wu, the chairman of the board, indicates that Compass should review the long-term trends in the country (the United Kingdom) before deciding.

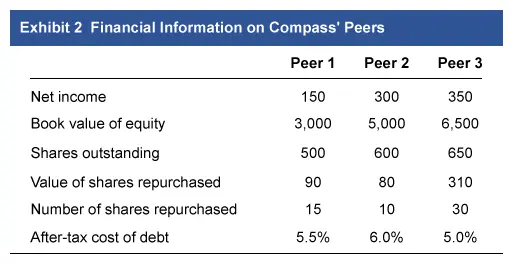

After deliberation, the board favors a share repurchase program. Jessica King, another member of the board, is concerned about the effect of share repurchases on Compass’ EPS. She collects the following data for 20X2:

In addition, King wonders what effect share repurchases have on companies’ book values. She gathers data from three of Compass’ peers who have made a share repurchase:

The board members then discuss the best approach for Compass to repurchase shares. King has identified two possible scenarios, both using the same amount to repurchase shares:

Scenario 1: Purchase shares using all cash on hand.

Scenario 2: Purchase shares with funds from an issuance of debt.

Wu states that her preference is to choose a method by which the company can control the process and execute it quickly. She also prefers a process that would allow Compass to discover the minimum price at which it can repurchase the desired number of shares.

Based on Scenario 1 and Exhibit 1, a share repurchase would cause Compass’ 20X2 EPS to be closest to:

- £6.72

- £6.77

- £6.80

Explanation:

Share repurchases are a popular alternative to cash dividends for returning cash to shareholders. Repurchases allow companies to purchase shares currently being held by shareholders using one of several methods. Once repurchased, the shares are either held for reissue (ie, treasury shares) or retired (ie, canceled shares).

The repurchase leaves fewer shares for investors to hold (ie, shares outstanding), which often results in a change to a company’s per-share financial ratios (eg, EPS). Like dividends, share repurchases are made using corporate cash, whether the cash is on hand or obtained through the issuance of new debt.

- When cash on hand is used, EPS always increases.

- When new debt is issued, the change in EPS depends on the company’s after-tax cost of debt and its earnings yield.

In this question, Compass’ EPS following the share repurchase would be £6.77, calculated below.

(Choice A) £6.72 results from incorrectly applying the company’s tax rate to the cash used to repurchase shares, arriving at cash of £400 million [£500 million × (1 − 0.2)].

(Choice C) £6.80 incorrectly uses the company’s share price instead of the purchase price to calculate the number of shares repurchased. Companies do not always repurchase shares at the market price.

Things to remember:

Share repurchases are a popular alternative to cash dividends. They often result in a change to a company’s per-share financial ratios. When cash on hand is used for a repurchase, EPS will always increase. When new debt is issued instead, the change in EPS depends on a company’s after-tax cost of debt and its earnings yield.

Passage

Tom Johnson, CFA, is a portfolio manager at Universal Advisors, a US-based wealth management firm that serves high-net-worth individuals and families. Universal’s equity portfolio offering includes separately managed accounts (SMAs) in which clients own individual securities. Johnson manages the portfolio with an aggressive high-risk, high-reward strategy, investing mostly in small-cap growth stocks. To reduce transaction costs and to simplify trading and settlement, Universal buys only US-listed securities for client accounts.

Johnson instructs Francois Martin, a CFA Level II candidate and new equity analyst at the firm, to conduct research on Vent Industries, a French wind turbine manufacturer. Vent is dually listed on exchanges in France and in the US. Martin, a French national who recently moved to the US, is already familiar with the company since he has been following it personally for the past two years.

After completing due diligence on Vent, Martin is thoroughly impressed by the investment prospects and suggests that Johnson add the US-listed shares of Vent to client portfolios. Johnson, as the sole decision-maker, reviews Martin’s research and financial models but wants to think about the suggestion before reaching a conclusion.

Martin is so impressed with Vent’s investment prospects that he wants to buy it for his personal account. For guidance, Martin references Universal’s publicly available personal transaction disclosure, which states only the following:

“Investment personnel are subject to policies and procedures regarding their personal trading.”

Needing more detail, Martin checks with the firm’s compliance officer, who informs him that the firm does have policies and procedures designed to prevent potential conflicts of interest related to personal trading. Universal does not require that employees obtain preclearance before trading, but the firm’s policies do require:

- a two-day blackout period before and after client trades, and

- a quarterly report by its investment decision-making personnel on transactions and holdings.

Based on this information, Martin immediately places an order to buy Vent shares listed in France through his personal French brokerage account, which he established prior to joining Universal. Three days later, Johnson decides to invest for clients in the US-listed shares of Vent and places the order through Universal’s trading desk.

Johnson is a board member for a local hospital endowment; for this, he receives modest compensation. Universal has approved Johnson’s board participation and compensation. Johnson is considered to be a thoughtful and successful investor. The other board members, unhappy with the fees and performance of the endowment’s existing income-oriented large-cap equity manager, asked Johnson a year ago if he would be willing to manage the equity portion of the endowment. Johnson responded by stating:

“The hospital provides so much to this community, I would be happy to manage the endowment’s equity portfolio. It won’t even take much time; I will manage the endowment portfolio as an exact replica of Universal’s equity portfolio.”

The next month, without informing Universal, Johnson began managing the endowment portfolio as a mirror image of Universal’s equity strategy.

Recently, Johnson evaluated the investment prospects of an upcoming IPO for a small-cap biotech firm. The company does innovative cancer research, but it is still years away from profitability. After conducting thorough due diligence, Johnson has concluded this is a great investment opportunity; he would like the hospital endowment to participate, believing the other board members would be excited about the company’s cancer research.

Johnson speaks to Universal’s lead underwriter and requests that 5% of the firm’s IPO allotment be allocated to the endowment. A few days later, when the IPO is priced and allocated, Universal receives 95,000 shares and the endowment receives 5,000 shares.

Which of Universal’s procedures for personal investing by employees is inconsistent with CFA Institute’s required and recommended procedures?

- There is no preclearance requirement.

- Transaction and holdings disclosures are not frequent enough.

- The blackout period is insufficient to prevent front-running of client trades.

Explanation:

“Investment transactions for clients and employers must have priority over investment transactions in which a Member or Candidate is the beneficial owner.”

Standard VI(B) Priority of Transactions stipulates that once a firm has established a policy on personal investing, specific reporting of personal holdings and securities transactions of investment personnel is required to ensure the policy is enforced. Since the policy’s overriding goal is to address client concerns regarding personal securities transactions and any conflicts of interest for the firm’s employees, enforcement procedures must also be established.

Key elements of the enforcement requirements include:

- Initial disclosure of holdings in which an employee has beneficial ownership (eg, for self, trust, spouse)

- Holdings disclosure, at least annually

- Duplicate transaction confirmations and periodic statements provided to the employer

- Preclearance procedures before the employee can trade

(Choice B) Standard VI(B) stipulates that duplicate transaction confirmations and periodic statements be provided, but it does not specify how frequently. Transaction confirmations should be done at the time of trade to ensure adequate supervision of activity, but quarterly holdings disclosure is adequate and common in most circumstances.

(Choice C) A blackout period is a recommended (not required) policy, and each firm has discretion regarding the period’s duration. Although the minimum period is not specified, a blackout of two days before and after a client trade is likely adequate to minimize market impact and prevent a conflict of interest and/or front-running of client trades.

Things to remember:

The key requirements of Standard VI(B) for investment personnel include trade preclearance and reporting personal holdings and securities transactions.

Passage

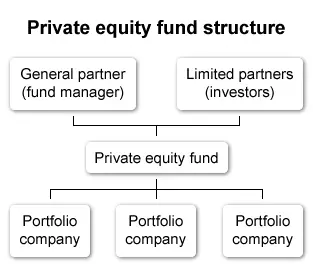

Chao Li is a vice president at Tailwind Capital, a private equity (PE) firm. He is currently raising £100 million for Tailwind Fund A. Li meets with An Heng, an associate at Insular Insurance Co., a potential institutional investor. In their meeting, Li explains the general structure of PE funds to Heng:

Statement 1: The limited partners (LPs) and the general partner (GP) in a private equity fund participate in managing the fund.

Statement 2: The GP is entitled to carried interest, which is typically a percentage of the fund’s profits after management fees.

Statement 3: PE funds are closed-end funds, so LPs can redeem their investments only at specified times.

Heng says, “I understand there are costs associated with investing in PE, such as significant performance fees, dilution costs whenever the PE firm starts new funds, and annual audit costs. And I know that there are some agency risks involved with investing in a PE fund. Is there a governance provision that would address GP gross negligence?”

Subsequently, Li raises the full £100 million for Fund A. One of the fund’s investments is ModernWare, an online services company. The initial investment is £20 million: £13 million in debt, £2 million in preferred equity, and £5 million in the PE fund’s equity. Tailwind plans to sell ModernWare 5 years from now and plans to reduce the debt balance by £10 million by the time of exit. The promised return for the preferred equity holders is 15%.

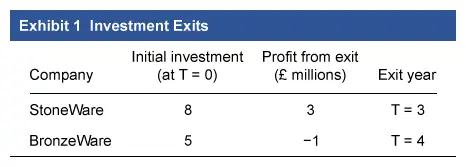

Several years after the fund’s inception, Tailwind exits two investments: StoneWare and BronzeWare (Exhibit 1). Carried interest to the GP is accrued on a deal-by-deal basis and equals 20% of the profits from each exit. The hurdle rate is 10%. When a deal’s IRR is above the hurdle rate, carried interest is accrued; when a deal’s IRR is below the hurdle rate, a clawback penalty amount is accrued if there is a loss.

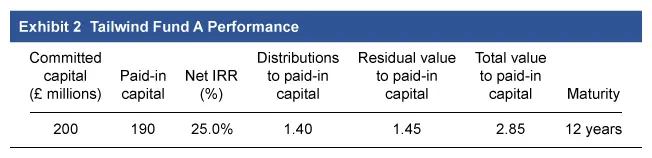

Twelve years after the fund’s inception, Li meets with Heng again to review Fund A’s performance, shown in Exhibit 2.

Which of Li’s statements on Tailwind’s fund structure is incorrect?

- Statement 1

- Statement 2

- Statement 3

Explanation:

Statement 1: The limited partners (LPs) and the general partner (GP) in a private equity fund participate in managing the fund.

Statement 2: The GP is entitled to carried interest, which is typically a percentage of the fund’s profits after management fees.

Statement 3: PE funds are closed-end funds, so LPs can redeem their investments only at specified times.

PE funds are typically structured as limited partnerships in which the GP (ie, fund manager) acts as an agent on behalf of the LPs (ie, investors). The GP actively manages the fund and is responsible for all debts (ie, unlimited liability). The LPs commit capital to the GP, and their liabilities are limited to their invested amounts. Statement 1 is incorrect since LPs are not actively involved in managing the fund.

(Choice B) In exchange for managing funds, GPs charge management fees, some transaction fees, and carried interest.

(Choice C) PE funds are closed-end funds since existing investors are restricted from redeeming their shares for long periods of time. In addition, new investors can be restricted from entering the fund during certain windows.

Things to remember: A private equity fund consists of a general partner (GP) (ie, fund manager) and limited partners (ie, investors). The GP is entitled to management fees and carried interest in exchange for managing the fund. However, the GP is responsible for all the fund’s debt (ie, unlimited liability), whereas the limited partners’ liabilities are limited to their invested amounts.

Passage

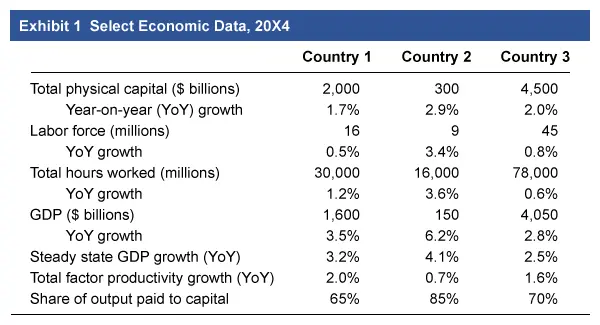

Botan Saito is a portfolio manager for Spire Financial. Spire’s investments are largely domestic, and Saito plans to diversify Spire’s holdings by adding investments in international markets. Saito identifies three countries that he will research further. He collects the following economic data for each country, using average year-on-year growth rates:

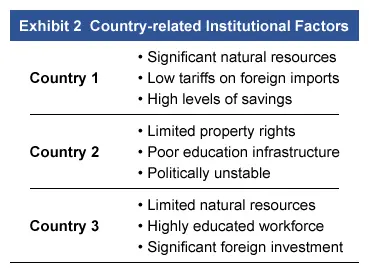

During his research, Saito realizes that numbers are not fully explaining the economic differences in these countries. He further researches institutional economic information, shown in Exhibit 2:

Country 2 is planning to implement new policies that create a more open trade policy. Saito expects that this will result in a higher permanent steady-state GDP growth rate.

Saito is interested in how economic factors will ultimately impact each country’s stock market. He notes that Country 3’s:

- GDP growth is slightly above the country’s steady-state GDP growth rate in 20X4;

- earnings-to-GDP ratio was above the country’s historical average in 20X4; and

- price-to-earnings ratio of the country’s publicly traded stocks was below its historical average in 20X4.

Saito is also interested in how potential GDP will affect each country’s bonds. He arrives at the following conclusions:

Conclusion 1 Actual GDP growth relative to a country’s potential GDP growth rate is an important factor in central bank decision-making and the likelihood of changes to the central bank’s policies.

Conclusion 2 A decrease in a country’s potential GDP growth rate increases the likelihood that the credit ratings on its sovereign debt will be downgraded.

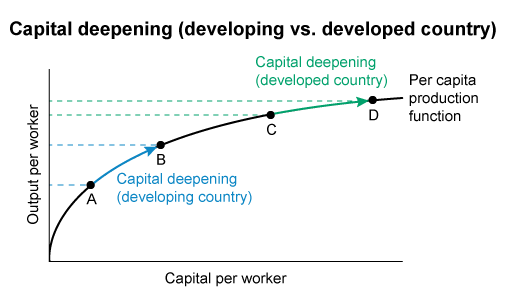

Saito wishes to identify how capital deepening will affect each country’s per capita output growth. Based on the neoclassical model, which of the following factors is most appropriate for Saito to consider?

- Capital-to-labor ratio

- Steady-state GDP growth

- Average hours worked per worker

Explanation:

Capital deepening is an increase in a country’s capital per worker (ie, capital-to-labor ratio). When workers gain more capital, they traditionally become more productive. However, the neoclassical model of economic growth states that the per capita production function, which measures capital per worker against output per worker, exhibits diminishing marginal returns. Therefore, when a country has a greater capital-to-labor ratio, it will likely see a smaller per capita output increase from capital deepening than if it had a lesser capital-to-labor ratio, all else equal.

(Choice B) Steady-state GDP growth considers several factors, including capital growth, labor growth, capital and labor as a percentage of total factor cost, and total factor productivity. Therefore, this measure would not be the most appropriate to identify how capital deepening will affect each country’s growth in output per capita.

(Choice C) Average hours worked per worker affects the factor of labor, not capital, when calculating economic output. Therefore, this measure would not be the most appropriate to use when specifically identifying how capital deepening will affect each country’s growth in output per capita.

Things to remember:

Capital deepening is an increase in a country’s capital per worker. In the neoclassical model, the per capita production function has diminishing returns. Therefore, a country with a greater capital-to-labor ratio will likely see a smaller output increase from capital deepening than a country with a lesser capital-to-labor ratio.

Passage

Herman Schmidt is a fund manager working at Rosige Zukunft LLC (RZ), a derivatives trading firm. RZ uses the carry arbitrage model to assess the value of bond forward contracts. Exhibit 1 contains information on several German government bonds that pay coupons once per annum and have five years remaining until maturity. Schmidt directs Hedwig Meyer, an RZ analyst, to price forward contracts on Bond A, Bond B, and Bond C. The 6-month risk-free rate is 1.50% and the 1-year risk-free rate is 2.00%.

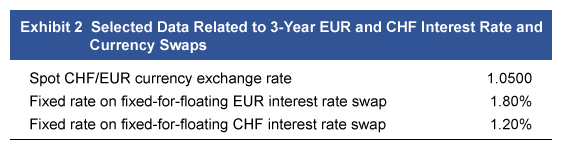

Schmidt and Meyer discuss different methods for valuing interest rate and currency swaps. Exhibit 2 contains information on at-market EUR and CHF interest rate swaps, and the CHF/EUR exchange rate.

Schmidt has RZ initiate a fixed-for-fixed EUR/CHF currency swap, agreeing to pay 1.20% in CHF and receive 1.80% in EUR. RZ exchanges the swap notional with the counterparty at contract initiation, paying EUR 10 million and receiving CHF 10.5 million. Six months later, at-market 2.5-year fixed-for-fixed EUR/CHF currency swaps are quoted at 1.60% EUR for 1.40% CHF and the spot CHF/EUR exchange rate is 1.1000.

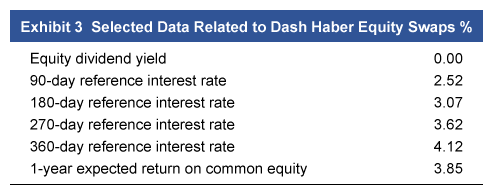

Schmidt anticipates that the equity of Dash Haber Ltd., a UK clothing retailer, will outperform versus expectations. He decides to use a 1-year, quarterly settled, equity-return-for-fixed-interest rate swap to gain long exposure to Dash Haber equity. Exhibit 3 contains information related to the swap:

All interest rates are annual compound rates and are based on a 360-day year.

Based on Exhibit 1, the no-arbitrage 6-month forward price of Bond A is most likely:

- less than its spot price.

- equal to its spot price.

- greater than its spot price.

Explanation:

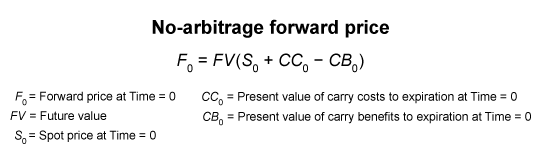

The no-arbitrage forward price of an asset is the:

- future value of the asset’s spot price, adjusted for the

- costs and benefits (ie, “carry” costs and benefits) of holding the asset to the forward contract expiration.

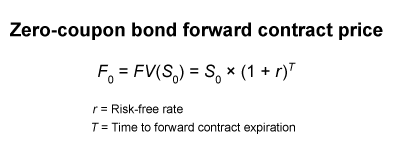

The forward price of a zero-coupon bond is just the future value of the bond’s spot price since there are:

- no explicit carry costs, due to the opportunity cost of capital being captured in the future value of the spot price, and

- no carry benefits since a bondholder receives no periodic coupon payments.

As a result, CC0 and CB0 in the formula above both equal 0, reducing the calculation of the no-arbitrage forward price to:

In this scenario, the 6-month forward price of the 5-year zero-coupon bond (ie, Bond A) is calculated as:

F0 = 86.261 (1.015)0.5 = 86.906

If interest rates are positive, the no-arbitrage forward price of an asset with no holding costs or benefits is greater than the asset’s spot price (Choices A and B). The spot/forward price difference reflects the opportunity cost of capital (eg, cost of financing a position in the asset) over the time to the forward contract expiration.

Things to remember:

The no-arbitrage forward price of an asset is the future value of the asset’s spot price adjusted for the costs and benefits of holding the asset to the forward expiration. The forward price of an asset with no holding costs or benefits is above the asset’s spot price by the opportunity cost of capital over the time to the forward expiration.

Tom Harris is undertaking an analysis of the electric scooter industry. He hypothesizes that scooter sales (SALES) are a function of three factors: the population under 20 (POP), the level of disposable income (INCOME), and the number of dollars spent on advertising (ADV). All data are measured in millions of units. Harris gathers data for the last 20 years. Which of the following regression equations correctly represents Harris’ hypothesis?

- SALES = α + β1 POP + β2 INCOME + β3 ADV + ε.

- SALES = α x β1 POP x β2 INCOME x β3 ADV x ε.

- INCOME = α + β1 POP + β2 SALES + β3 ADV + ε.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. SALES is the dependent variable. POP, INCOME, and ADV should be the independent variables (on the right-hand side) of the equation (in any order). Regression equations are additive.

Which of the following statements regarding covariance stationarity is CORRECT?

- A time series may be both covariance stationary and heteroskedastic.

- The estimation results of an AR model involving a time series that is not covariance stationary are meaningless.

- A time series that is covariance stationary may have residuals whose mean changes over time.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. Covariance stationarity requires that the expected value and the variance of the time series be constant over time.

The procedure for determining the structure of an autoregressive model is:

- estimate an autoregressive model (e.g., an AR(1) model), calculate the autocorrelations for the model’s residuals, test whether the autocorrelations are different from zero, and revise the model if there are significant autocorrelations.

- estimate an autoregressive model (for example, an AR(1) model), calculate the autocorrelations for the model’s residuals, test whether the autocorrelations are different from zero, and add an AR lag for each significant autocorrelation.

- test autocorrelations of the residuals for a simple trend model, and specify the number of significant lags.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. The procedure is iterative: continually test for autocorrelations in the residuals and stop adding lags when the autocorrelations of the residuals are eliminated. Even if several of the residuals exhibit autocorrelation, the lags should be added one at a time.

Tim Watson, CFA, is analyzing sales data for the Tricon Corp, a current equity holding in her portfolio. He observes that sales for Tricon Corp. have grown at a steadily increasing rate over the past ten years due to the successful introduction of some new products. Tim anticipates that Tricon will continue this pattern of success. Which of the following models is most appropriate in her analysis of sales for Tricon Corp?

- A log-linear trend model, because the data series can be graphed using a straight, upward-sloping line.

- A log-linear trend model, because the data series exhibits a predictable, exponential growth trend.

- A linear trend model, because the data series is equally distributed above and below the line and the mean is constant.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. The log-linear trend model is the preferred method for a data series that exhibits a trend or for which the residuals are predictable. In this example, sales grew at an exponential, or increasing rate, rather than a steady rate.

Betty Harris, CFA, is considering the purchase of an equity position in Hammer Tech, Inc, a leading seller of hand tools in the United States. Betty has obtained monthly sales data for the past seven years, and has plotted the data points on a graph. She notices that the revenues are growing at approximately 4.5% per year. Which of the following statements regarding Harris’ analysis of the data time series of Hammer Tech’s sales is most accurate? Betty should utilize a:

- mean-reverting model to analyze the data because the time series pattern is covariance stationary.

- log-linear model to analyze the data because it is likely to exhibit a compound growth trend.

- linear model to analyze the data because the mean appears to be constant.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A log-linear model is more appropriate when analyzing data that is growing at a compound rate. Sales are a classic example of a type of data series that normally exhibits compound growth.

Compare our Content with our competitors.

Passage

Denise Duckworth is the chief investment officer at Duckworth Financial, Inc. (DFI), her father’s firm specializing in international opportunities. In addition to other duties, Duckworth manages the high-net-worth (HNW) portfolio managers (PMs) at DFI. One of her PMs, Emile Arroyo, is attempting to select from among the equity securities of three companies in Exhibit 1.

Exhibit 1: Arroyo – Equity Securities List

Company Description

| A | Aggressive management. Development of new products and markets. Simultaneous acquisitions in pursuit of those strategic goals. No dividends. Perhaps slightly overvalued based on DFI analysis. Headquartered in Brazil. |

| B | Natural resources company headquartered in Argentina. Expected to benefit from rising commodity prices. Able to pass cost increases on to its customers. |

| C | Well-established company with great share liquidity in international markets. Consistent and slowly growing dividend payments to shareholders. Headquartered in Belgium. DFI analysis has indicated “C” to be undervalued. |

Arroyo’s client, Aleksandr Dmitri, had recently come to him with concerns about lacking inflation protection in his equity portfolio. Arroyo then brought the situation to Duckworth’s attention. “I’m sure you’ll make the right decision,” Duckworth told him.

Arroyo, who has all actively managed portfolios, tells Patty Llewellyn, another PM with all passively managed portfolios, that he will constructively engage with the management of whichever company or companies he chooses for his client portfolios from now on. Llewellyn notes that Companies B and C are in her benchmark index.

Later that evening, Duckworth is approached at a social function by Charles Millicent, a well-known trust fund beneficiary. Millicent expects to receive a scheduled distribution of capital from the trust and wishes to reinvest rather than spend it. “I’m more interested in something that will produce an ongoing stream of income while protecting me from inflation,” he says. “At the same time, I have doubts that any of the widely followed companies that would meet my criteria will earn returns substantial enough to recover active management expenses.”

Duckworth agrees that she will have one of her many PMs call Millicent the next day.

Which of the following is correct regarding Duckworth’s assignment of Millicent’s account?

- Arroyo is more likely than Llewellyn to get the account.

- Llewellyn is more likely than Arroyo to get the account.

- Neither Arroyo nor Llewellyn is likely to get the account.

Explanation:

Incorrect. Llewellyn will likely get the account because she is indexed to more stable large-cap companies, some of which suggest inflation protection (e.g., Company B). Further, Llewellyn must manage to an index of large-cap core securities, further fitting Millicent’s requirements to avoid active management expenses on the types of companies that would fit his criteria.

Correct. Llewellyn will likely get the account because she is indexed to more stable large-cap companies, some of which suggest inflation protection (e.g., Company B). Further, Llewellyn must manage to an index of large-cap core securities, further fitting Millicent’s requirements to avoid active management expenses on the types of companies that would fit his criteria.

Incorrect. Llewellyn will likely get the account because she is indexed to more stable large-cap companies, some of which suggest inflation protection (e.g., Company B). Further, Llewellyn must manage to an index of large-cap core securities, further fitting Millicent’s requirements to avoid active management expenses on the types of companies that would fit his criteria.

Using a derivative that is imperfectly matched to the underlying will most likely result in:

- tail risk.

- basis risk.

- currency risk.

Explanation:

(Choice A) Incorrect. Basis risk describes the difference in return from a derivatives portfolio to a portfolio of the underlying.

(Choice B) Correct. Basis risk describes the difference in return from a derivatives portfolio to a portfolio of the underlying.

(Choice C) Incorrect. Basis risk describes the difference in return from a derivatives portfolio to a portfolio of the underlying.

Passage

Serena Escobar is the chief investment officer (CIO) for Hiltl Investments, a large mutual fund company. Escobar has been discussing liquidity risk and tail risk with a group of interns in the portfolio management program. During the conversation, Escobar made two statements about bid-ask spread in high-yield and investment-grade markets.

| Statement 1: | High-yield spread is usually measured in currency units. |

| Statement 2: | Investment-grade spread is measured in basis points over a reference rate, usually a government fixed-income security. |

One of the interns asks Escobar about a list of bonds for potential inclusion in the Hiltl Emerging Markets Opportunities Fund (HEMOX). The candidate, Amar Elba, is surprised to see that Pinkston Mining, a multinational commodities producer, has the same credit rating as its country’s BB+ sovereign debt. “That company is in a lot of portfolios and I thought it was a stronger credit,” Elba says, somewhat surprised.

Other interns are more interested in the new Hiltl Structured Financial Instruments Fund (HSFIX). Escobar agrees with the interns that the fund offers opportunities for investors wishing to avoid holding individual MBS/ABS securities. She describes the situation in which a high-net-worth (HNW) client held a senior tranche and a subordinated tranche of an ABS with default correlation that changed from +1 to −1. The HNW client had no idea how to properly hedge the risk.

“Jenny Henley specifically looks at the relative value of tranches for any CDO investments in the Structured Financial Instruments Fund,” Escobar tells her interns, introducing Henley. During her explanation, Henley makes three comments.

| Comment 1: | Collateralized loans are CDOs with leverage loans serving as the underlying. |

| Comment 2: | Mezzanine and equity tranches essentially leverage the assets from the underlying credits. |

| Comment 3: | During a financial crisis, the triple-A and double-A tranches are likely to survive; therefore, a PM would short the more secure credits and go long the mezzanine and equity tranches. |

As Henley closes, Escobar takes that opportunity to announce a new fund, Hiltl Fixed-Income Strategic Opportunities Fund (HFISX). During her discussion of the new fund, she notes that the fund is likely to include high-yield credits and floating-rate notes. She then makes three observations.

| Observation 1: | It is appropriate to use spread duration rather than modified duration for the new portfolio. |

| Observation 2: | If interest rates change, a portfolio of floaters is unlikely to experience much change in value. |

| Observation 3: | If interest rates change, an investment-grade portfolio is unlikely to experience much change in spread. |

Based on Elba’s description of HSFIX, the fund most likely focuses on:

- covered bonds.

- the senior tranches of the securities.

- the mezzanine tranches of the securities.

Explanation:

Incorrect. More risk-tolerant investors, such as in HSFIX, are likely to favor mezzanine tranches due to the greater return. The senior tranches have less risk and return, as do covered bonds. Covered bonds generally refer to financial institutions with a cover pool. In the event of default, investors have access to both the institution’s assets and the cover pool. This decreases the risk and return of an investment in such securities.

Incorrect. More risk-tolerant investors, such as in HSFIX, are likely to favor mezzanine tranches due to the greater return. The senior tranches have less risk and return, as do covered bonds. Covered bonds generally refer to financial institutions with a cover pool. In the event of default, investors have access to both the institution’s assets and the cover pool. This decreases the risk and return of an investment in such securities.

Correct. More risk-tolerant investors, such as in HSFIX, are likely to favor mezzanine tranches due to the greater return. The senior tranches have less risk and return, as do covered bonds. Covered bonds generally refer to financial institutions with a cover pool. In the event of default, investors have access to both the institution’s assets and the cover pool. This decreases the risk and return of an investment in such securities.

Passage

Dava Vij is assessing several strategies for implementing a passive factor-based strategy for the Bela Planta Fund (BPF), the USD 1 billion fund of a tax-exempt organization that promotes the tropical ecosphere in Mozambique. Vij is working with the chief programs officer (CPO) at BPF, Grace Cabral, and makes the following three statements:

| Statement 1: | Passive factor-based investing may also be known as “smart alpha.” |

| Statement 2: | Passive factor-based investing requires making active management decisions upfront rather than continuously. |

| Statement 3: | Passive factor-based investing strategies tend to concentrate risk exposures relative to broad-market-capitalization-weighted approaches. |

Cabral likes the idea of doing this but is concerned that it will increase management costs. Based on their working documents and the BPF investment policy statement (IPS), Vij is also aware that the fund cannot use leverage or any type of derivative security. Cabral has indicated that the fund would like to be able to passively manage the funds but perhaps engage in shareholder activism where BPF can influence factors that address the fund’s mandate.

Vij describes three implementation approaches:

| Approach 1: | Derivatives-based approaches |

| Approach 2: | Separately managed equity index-based portfolios |

| Approach 3: | Pooled investments such as open-end mutual funds and ETFs |

Cabral then asks Vij how the funds in a separately managed account could be cost-effectively employed given that they have chosen to benchmark against the MSCI ACWI, which has over 3,000 constituents and includes emerging markets where some securities may have limited liquidity. Vij describes three index replication methods.

Cabral and Vij meet two quarters later. During that time, the portfolio value declined more than the MSCI ACWI, but rose quickly toward the end of the measurement period. Cabral was surprised by the resulting tracking error over the period.

Which of the following is correct regarding use of market-on-close (MOC) transactions to replicate the benchmark index for the passive strategy?

- Approach 1 is unlikely to use MOC transactions.

- Only Approaches 1 and 3 are likely to use MOC transactions.

- Any of the three approaches are likely to use MOC transactions.

Explanation:

Incorrect. All three approaches are likely to use MOC transactions to achieve the price of the security that the index would record. This is true of derivatives designed to follow underlying securities that are constituents of the index, just as it would the securities themselves in the pooled investments or separate account.

Incorrect. All three approaches are likely to use MOC transactions to achieve the price of the security that the index would record. This is true of derivatives designed to follow underlying securities that are constituents of the index, just as it would the securities themselves in the pooled investments or separate account.

Correct. All three approaches are likely to use MOC transactions to achieve the price of the security that the index would record. This is true of derivatives designed to follow underlying securities that are constituents of the index, just as it would the securities themselves in the pooled investments or separate account.

Passage

Afshid Burnette directs fixed-income portfolio management for Diller Investments. Burnette has several newly promoted assistant portfolio managers (PMs) with varying degrees of experience. In a meeting with these managers, Burnette makes the following statements:

| Statement 1: | The standard deviation of high-yield—that is, less than investment grade—bonds can rise significantly during periods of financial stress. |

| Statement 2: | Long-maturity bonds are particularly susceptible to increasing return volatility during periods of financial stress. |

| Statement 3: | Portfolios laddered to receive high-quality bond income and principal payments on specific dates are particularly susceptible to large cash flow misses during periods of financial stress. |

Reggie Stansfield, one of the assistant PMs, told Burnette after the meeting that he really had his hands tied by a client portfolio and that they should speak with the client. The IPS for that portfolio required cash flow matching along with minimum cost constraints on each of the matching positions. Stansfield was puzzled by how he would meet those contradictory constraints given a portfolio already in place. He recognized that several less expensive securities would easily reduce portfolio capital needs after transactions costs.

Stansfield provides one example of a very long-term liability that has been theoretically defeased using on-the-run shorter-term securities that can be rolled over until needed to pay the liability. The last of the expected rolled positions will mature at the time the liability is due. The low return on the instruments and trading costs for rollovers has reduced portfolio return over time.

Another assistant PM, Juliana duBois, asked Burnette how a parallel decrease in the yield curve would affect a cash-flow-matched portfolio with maturities exactly paired to the liability due date.

Elena Machado, the newest assistant PM, helps manage a portfolio that employs leverage. She expressed to Burnette that she had been pleased with the return enhancement achieved by using a reverse repo agreement.

Paul Hemingway is the manager of a taxable investor’s portfolio. Hemingway is concerned that the portfolio manager for the account has misled the investor about taxes he will pay on a recent zero-coupon bond investment. The investor’s jurisdiction considers imputed interest the same as coupon cash flows for tax purposes. The manager, however, suggested the investor could pay tax at a capital gains rate on the price change over the term. Hemingway is certain the investor will keep the zero-coupon bonds through their maturity.

Stansfield’s concerns with switching to a longer-maturity security would most likely relate to:

- liquidity.

- higher transactions costs at rollover.

- portfolio volatility resulting from higher duration.

Explanation:

Correct. Liquidity would be his greatest concern, although this will be minimal. Short-term securities, while highly liquid, provide greater uncertainty about the costs of the position at the next rollover. Transactions costs were considered in determining that the longer-maturity position would be cost effective. Also, portfolio volatility with the longer-maturity security may be higher although this is not a problem because it will better match the liability position. The balance sheet volatility for the client will therefore decrease with the longer-maturity position.

Incorrect. Liquidity would be his greatest concern, although this will be minimal. Short-term securities, while highly liquid, provide greater uncertainty about the costs of the position at the next rollover. Transactions costs were considered in determining that the longer-maturity position would be cost effective. Also, portfolio volatility with the longer-maturity security may be higher although this is not a problem because it will better match the liability position. The balance sheet volatility for the client will therefore decrease with the longer-maturity position.

Incorrect. Liquidity would be his greatest concern, although this will be minimal. Short-term securities, while highly liquid, provide greater uncertainty about the costs of the position at the next rollover. Transactions costs were considered in determining that the longer-maturity position would be cost effective. Also, portfolio volatility with the longer-maturity security may be higher although this is not a problem because it will better match the liability position. The balance sheet volatility for the client will therefore decrease with the longer-maturity position.

Imagine an economy forecasted to expand at its consistent long-term pace, with an inflation target set at 2%. Anticipate a 3% rise in the inflation index, while the central bank’s real neutral rate for short-term interest is at 1%. What would be the most appropriate figure for the target nominal short-term interest rate?

- 4.5%.

- 3.5%.

- 6.0%.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. The real neutral rate stands at 1%, and the anticipated inflation is 3%, leading to a nominal short-term rate adjustment to 4%. Considering the economy’s growth aligns with its long-term trajectory, this doesn’t alter the adjustment guided by the Taylor Rule. With the current inflation rate at 3% and a 2% target, the central bank is likely to augment interest rates by half the difference, culminating in a nominal target rate of 4.5%.

(Module 1.4, LOS 1.h)

When analyzing economic indicators, the method that most accurately describes the evaluation of the proportion of indicators that are rising compared to those that are declining within a composite is known as a:

- lagging indicator.

- diffusion index.

- checklist assessment.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A diffusion index is used to measure economic indicators by determining the ratio of components within a composite indicator that are increasing versus those that are decreasing. Lagging indicators, on the other hand, reflect the economic activities of the recent past. Checklist assessments involve a comprehensive evaluation of a broad array of economic data to predict the future state of an economy.

(Module 1.2, LOS 1.e)

Regarding the characteristics of econometric models in the context of economic forecasting, which description is most apt? Econometrics:

- may be able to forecast turning points accurately.

- may be relatively easy and efficient to develop with the right inputs.

- may provide reasonably reliable output.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. Econometric models, when applied correctly, can yield dependable models that incorporate a wide range of variables, closely mirroring real-world scenarios.

Conversely, economic models are often more complex and time-intensive to construct. They rarely predict turning points in the economy with high accuracy.

(Referenced from Module 1.2, LOS 1.e)

What aligns with a yield curve that slopes steeply upwards?

- Monetary policy is expansive, while fiscal policy is restrictive.

- Monetary policy is restrictive, and fiscal policy is restrictive.

- Monetary policy is expansive, and fiscal policy is expansive.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. A sharply upward-sloping yield curve, where short-term rates are lower than long-term rates, typically occurs when both fiscal and monetary policies are expansionary. This scenario often signals an expected expansion of the economy in the future.

(Module 1.4, LOS 1.i)

Identify the scenario that suggests international occurrences less influence a country. The country is:

- small and has a diversified economy.

- small and has an undiversified economy.

- large and has a diversified economy.

Explanation:

No Additional context, only the formula for the correct answer. The candidate will need to look up the reading for further clarity on the substance and significance behind the formula.Typical competitor QBanks (especially when free) are part of a much larger learning system that requires an additional purchase for clarity. Countries that are larger and possess a diversified economy tend to be less impacted by international events. In contrast, smaller nations with less diversified economies are more vulnerable to global happenings.

(Module 1.4, LOS 1.j)

Take Your CFA® Prep to the Next Level

You’ve tried our sample questions—now experience the full power of UWorld’s CFA prep.

Our complete course is designed to deepen your understanding, improve retention, and ensure you’re fully prepared on exam day.

Benefits of Practicing Exam-Like Questions

Benefit From Active and Visual Learning

Customize Quizzes to Your Needs

Learn From UWorld Answer Explanations

Experience the Future of CFA® Exam Prep

Carry expert-led lectures wherever you go. Swap social media scrolling for a bite-sized study session. Review a video in the back of an Uber or on your lunch break. Pause, speed up, and rewind—Watch at your own pace anytime, anywhere.

Access CFA practice questions written by our dedicated team of charterholders to meet or exceed exam-level difficulty. Each question is routinely updated to reflect the current exam format and CFA Institute learning outcome statements.

What if you could take the CFA exam before you took the CFA exam? We've developed an extensive library of exam-like practice questions and meticulously replicated every detail of the exam day experience—interface, question format, difficulty level, number of questions, time constraints, and topic weighting.

Identify knowledge gaps with advanced performance analytics so you don’t waste time studying what you already know. Track your progress by subject and topic, compare your results with peers, and feel confident going into the exam.

Create unlimited, customizable digital flashcards or use our pre-loaded ReadyDeck. Highlight and transfer source content to the front or back, add unique notes, and organize by subject, topic, or custom tag. Rate your understanding of each flashcard and let spaced-repetition technology adjust the frequency with which it's presented based on your proficiency.

Get a New CFA Exam Question in Your Inbox Every Week

Stay on track with UWorld’s Weekly CFA® Question—expert-created, exam-style, and complete with detailed explanations to strengthen your prep.

Explore CFA® Sample Questions by Topic

Ethical & Professional Standards

Sharpen your understanding of ethics, professional conduct, and GIPS.

Try Ethics sample questionsQuantitative Methods

Strengthen your grasp on probability, statistics, time value of money, and regression analysis.

Try Quantitative Methods sample questionsEconomics

Test your knowledge of microeconomics, macroeconomics, and global economic systems.

Try Economics sample questionsFinancial Reporting & Analysis (FRA)

Master financial statements, ratios, cash flows, and accounting standards.

Try FRA sample questionsCorporate Finance

Practice questions on capital budgeting, cost of capital, working capital management, and corporate governance.

Try Corporate Finance sample questionsEquity Investments

Assess your skills in valuation models, equity markets, and industry/sector analysis.

Try Equity Investments sample questionsFixed Income

Work through bond pricing, yield curves, duration, and credit analysis.

Try Fixed Income sample questionsDerivatives

Understand forwards, futures, options, and swaps through CFA-style practice questions.

Try Derivates sample questionsAlternative Investments

Evaluate hedge funds, private equity, real estate, and commodities.

Try Alternative Investments sample questionsPortfolio Management

Build your understanding of portfolio theory, risk management, and the investment policy statement.

Try Portfolio Management sample questionsHear From Our Past CFA Candidates

UWorld CFA Qbank questions challenge me to think from different perspectives, which is great. It is helping me to strengthen the concepts I remember and relearn the ones I forgot. Also, the feature to make Qbank with varied topics and in the same theme as the official exams is perfect."

A great set of CFA questions that hit all parts of the exam and the questions are well organized by sections. Your explanations are really useful and way better than CFAI Qbank. I'll purchase your Level 2 packages when I pass L1 and take L2. Overall a great platform to practice."

UWorld CFA exam questions are very nicely written and challenging, putting me in a state of mind that I have to keep going and improve. The Qbank is harder IMO than Schweser and CFA qbank. Answer explanations are AWESOME. The only QBank I've used so far that tests all topics in the material!"

Frequently Asked Questions

Yes. UWorld’s CFA sample questions are written by CFA charterholders to mirror the wording, logic, and difficulty of actual CFA Institute questions. As an Approved Prep Provider, UWorld ensures every question aligns with the latest Learning Outcome Statements (LOS) and exam updates.

Most candidates complete 2,000–3,000 practice questions before the exam. UWorld’s CFA QBank and example questions are designed to meet this target, offering detailed rationales, visuals, and analytics to help you improve efficiently.

Yes. UWorld provides sample questions for CFA Levels 1, 2, and 3, each modeled after the actual exam’s style and difficulty. These examples help you get a feel for how the real exam questions look and perform.

Yes. You can try free CFA sample questions directly on this page, with questions available for Levels 1, 2, and 3. Each set showcases real CFA-style questions from UWorld’s QBank, complete with visual explanations, detailed rationales, and adaptive review tools. It’s the perfect way to experience how UWorld prepares you for the actual exam before subscribing.

Most free CFA question sets only show answers, not reasoning. UWorld’s CFA prep questions include detailed, step-by-step explanations, visuals, and formula references — so every question becomes a learning opportunity.

Yes. UWorld’s CFA example questions are intentionally designed to be at or slightly above real exam difficulty. This helps candidates strengthen analytical reasoning, build confidence under pressure, and perform better on exam day.

Unlike generic CFA question sets, UWorld’s CFA exam practice questions include visual explanations, answer rationales, and real-world context. Each question teaches why an answer is correct, helping you learn concepts, not just memorize formulas.