| Ethics | ||

|---|---|---|

| Topic Weight | Number of Questions | |

| Level 1 | 15-20% | ca. 28 |

| Level 2 | 10-15% | 8-12 |

You should build a strong foundation in this topic, which will pay dividends as you progress through the material.

The Importance of Portfolio Management in the CFA Program

The fundamentals of the Portfolio Management process can be divided into 3 main steps: planning, execution, and feedback. In the planning phase, the manager acquires a deep understanding of the client's needs, whether an individual or an institutional investor. Subsequently, the manager compiles crucial information in the Investment Policy Statement, creating a documented plan that reflects the client’s return objectives, risk tolerance, and investing constraints.

Once the plan is established, the manager determines the appropriate asset allocation: how much of the client's portfolio should be allocated to each broad asset class, such as equity and fixed income, in alignment with the client's risk tolerance and desired return profile. The curriculum encompasses essential topics such as risk management, behavioral biases, and performance measurement. More recently, the curriculum has expanded to include fintech subjects including machine learning, big data, and distributed ledger technology.

Portfolio Management: What to Expect in the CFA Level 1 Exam

The Portfolio Management (PM) topic holds a relatively lower weight on the Level 1 CFA exam, along with Derivatives and Alternative Investments. It’s crucial for you to recognize that PM is not any less significant than heavily weighted subjects such as Financial Statement Analysis (FSA). Instead, PM is a more intricate subject that builds upon fundamental concepts introduced earlier in the CFA Program.

As you progress through the CFA Program, the importance of PM grows, becoming over half of the Level 3 exam. Therefore, you should regard the lower-weighted content on Level 1 as a primer for this essential CFA exam topic. Establishing a strong foundation in PM is pivotal for achieving success and obtaining a CFA charter.

Exam Weighting

The topic weighs 8-12% of the L1 total exam content, so approximately 15-21 of the 180 questions focus on this topic.

| No. of Learning Modules | No. of Formulas |

|---|---|

| 6 | ca. 50 |

Syllabus, Readings, and Changes

The 2025 PM syllabus spans 6 learning modules and contains 40 learning outcome statements (LOS), with its main focus on portfolio planning and management.

Overview

Diversification of investments within a portfolio enables risk reduction while maintaining reward potential. An essential initial step in the portfolio management process involves creating a tailored Investment Policy Statement (IPS) that aligns with the client’s specific requirements. This process is followed by asset allocation, security analysis, portfolio construction, ongoing monitoring, rebalancing, performance evaluation, and reporting.

The reading introduces portfolio management and the asset management industry. You will become familiar with the portfolio management process and the financial needs of various investors. The material also covers mutual funds and other pooled investment instruments.

Portfolio Risk and Return: Part I

The most critical factors in portfolio development are the risk and return of individual assets, and the most efficient portfolios optimize that trade-off for the investor.

The reading examines the characteristics of assets as they relate to risks and returns. You will study risk aversion, the computation of portfolio risk, and the theory behind the choices of optimal risky portfolios.

Portfolio Risk and Return: Part II

The reading dives deeper into the nuances of portfolio risk and return by examining the computation of risk, systematic and unsystematic risk, the capital asset pricing model (CAPM), and the role of correlation in diversifying risk. You will study various risk-related models and how risk influences portfolio valuation.

Basics of Portfolio Planning and Construction

A common theme reiterated throughout the CFA Level 1 PM topic is understanding a client’s situation and goals. While financial professionals categorize investors into broad groups, variations remain within these groups.

The reading examines the portfolio construction process with particular attention to client-centered planning. You will learn more about the investment policy statement and the portfolio construction process.

Behavioral Biases of Individuals

Human irrationality befuddles even the most realistic models. People often rely on their biases when making judgments and decisions. Behavioral finance challenges the assumptions of traditional economic and financial theories by accounting for this irrationality.

The reading examines the possible consequences of cognitive errors and emotional biases and how to mitigate their negative effects. You will also study how the aggregate expression of individual biases manifests as market anomalies.

Introduction to Risk Management

Investment decisions are always made within an environment of uncertainty. Risk management is a skill that allows investors to navigate this environment. To do this, investment advisers and managers must be able to identify appropriate risk measures and keep risks aligned with investment goals.

The reading offers a broad enterprise and portfolio risk management process overview. You will learn about risk governance, tolerance, and measuring and managing risk.

Portfolio Management: Overview

This topic centers on comprehending the portfolio investment approach and detailing the steps involved in portfolio management. It also examines diverse investor profiles, emphasizing their unique traits and requirements. The discourse extends to clarifying defined contribution and defined benefit pension plans, delving into facets of the asset management sector. Additionally, it encompasses an overview of mutual funds, accompanied by a comparative analysis of other pooled investment options.

Sample Questions and Answers

These sample questions are typical of the probing multiple-choice questions on the L1 exam. During the exam, you have about 90 seconds to read and answer each question, carefully designed to test knowledge from the CFA curriculum. UWorld’s question bank is built to expose you to exam-like questions and illustrate and explain the concepts tested thoroughly.

In relation to other portfolios, unattainable portfolios are located:

- below the capital market line

- on the capital market line

- above the capital market line

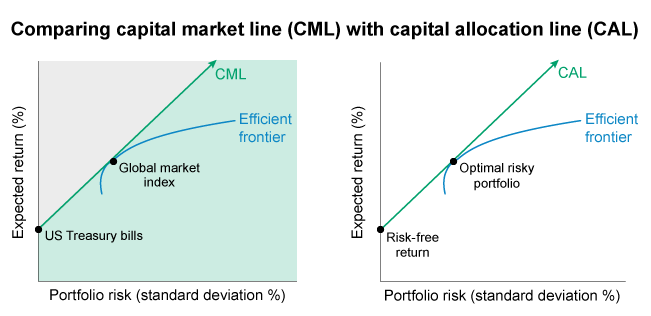

The capital market line (CML) is the practical form of the capital allocation line (CAL). The CAL represents theoretical portfolios combining the optimal risky portfolio and a risk-free asset. The CML replaces the optimal risky portfolio with the real market portfolio (eg, global market index) and uses short-term domestic government bonds (US Treasury bills) in place of the risk-free asset. All portfolios above the CML are unattainable (gray shaded area).

At each level of risk along the CML, there is no combination of assets that can produce a return greater than the return on the CML. All portfolios below the CML (green shaded area) are attainable but are suboptimal since portfolios along the CML have the highest return at each level of risk (Choices A and B).

The CML represents portfolios that hold a combination of the global market index and the US Treasury bills. The market portfolio is the portfolio on the efficient frontier at the point where a straight line that originates from the risk-free rate is tangent to the efficient frontier. All portfolios on the CML dominate all other achievable portfolios.

Things to remember:

Portfolios on the capital market line (CML) have the highest return for a given level of risk. Portfolios above the CML are unattainable, and portfolios below the CML are suboptimal.

Which of the following performance measures most likely ignores nonsystematic risk?

- M-squared

- Sharpe ratio

- Jensen’s alpha

| Portfolio evaluation measures | ||||

|---|---|---|---|---|

| Sharpe ratio | Treynor ratio | M-squared | Jensen’s alpha | |

|

Rp – Rf

/

σp

|

Rp – Rf

/

βp

|

(Rp – Rf )

σm

/

σp

+ Rf

|

Rp – [Rf + βp (Rm – Rf )] | |

| Standalone | ||||

| Comparative | ||||

| Rp = portfolio return | βp = beta of portfolio returns | σp = standard deviation of portfolio returns |

| Rf = risk-free rate | Rm = market return | σm = standard deviation of market returns |

Rp = portfolio return

Rf = risk-free rate

βp = beta of portfolio returns

Rm = market return

σp = standard deviation of portfolio returns

σm = standard deviation of market returns

Examining a manager’s return is only one part of a manager’s performance evaluation. Another part is determining how much risk the manager took to earn that return. In portfolio management, risk is quantified as either systematic risk (beta) or total risk (standard deviation).

Jensen’s alpha and the Treynor ratio are two performance measures that use beta as a measure of risk. Here, Jensen’s alpha is the only performance measure that uses beta (systematic risk) and ignores nonsystematic risk. Jensen’s alpha is the difference between an asset’s actual return and an asset’s return as predicted by the CAPM. If it is positive, then the manager has outperformed by having a greater return than its expected risk-adjusted return and vice versa.

(Choice A) M-squared is a performance measure based on total risk (standard deviation), not systematic risk (beta). It is a risk-adjusted performance measure, which determines how the portfolio performed relative to the market.

(Choice B) The Sharpe ratio measures excess return relative to the portfolio’s total risk (standard deviation), of returns, not beta.

Things to remember:

Jensen’s alpha and the Treynor ratio are two performance measures based on beta. M-squared and the Sharpe ratio are based on standard deviation (total risk). If Jensen’s alpha is positive, then the manager has exceeded expectations on a risk-adjusted basis.

Companies that raise capital through an initial coin offering (ICO) most likely benefit from:

- less dilution of ownership than through an initial public offering

- more regulation of cryptocurrencies than of traditional currencies

- central authority confirmation of future transactions involving tokens from the ICO

An initial coin offering (ICO) is similar to an initial public offering (IPO). As with an IPO, a company uses an ICO to raise funds, but investors receive cryptocurrency tokens instead of shares. The tokens usually do not convey voting rights, so one advantage of an ICO from the company’s perspective is that the owners retain the same ownership interest as before the ICO. The investors’ incentive is that the tokens may be worth more in the future.

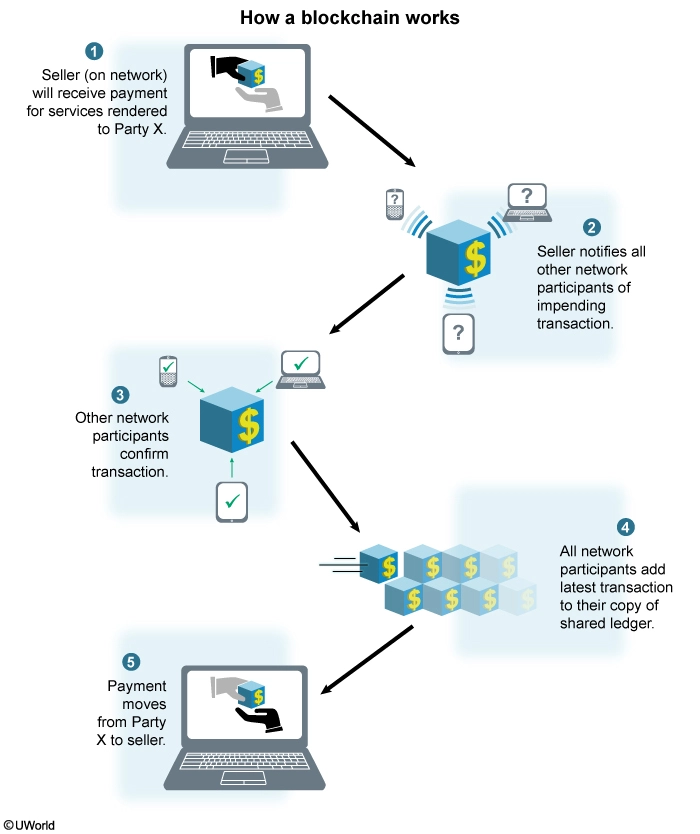

Cryptocurrency is an application of a broader fintech category known as distributed ledger technology (DLT). DLT is a database that is shared among multiple users on a network (ie, shared ledger). Transactions between users are communicated to all other users, and the ledger is updated through a process that ensures its integrity. Since all users have an identical copy of the ledger, each user can see every other transaction.

(Choice B) Cryptocurrency transactions are not highly regulated.

(Choice C) The network’s users maintain and update the ledger, so transactions involving tokens issued through an ICO are not recorded with a central authority such as a clearinghouse. Also, the ICO process is mostly unregulated, so investors in an ICO do not enjoy regulatory protection.

Things to remember:

An initial coin offering (ICO) is the cryptocurrency equivalent of an initial public offering. The investors receive tokens from the company instead of shares, so in most cases they have no ownership or voting rights. An ICO is one application of fintech known as distributed ledger technology (DLT), which is an electronic ledger of transactions shared among multiple users on a network.

Portfolio Management: What to Expect in the CFA Level 2 Exam

The Level 2 Portfolio Management syllabus discusses the creation, trading, costs, and risks of exchange-traded funds (ETFs) and how to use them strategically. You explore the connections between financial markets and the real economy and are introduced to the Fundamental Law of Active Management. The material wraps up with case studies of portfolio management, which demonstrate how securities trading relates to the investment process.

Exam Weighting

The CFA PM topic weighs 10-15% of the total exam content, so approximately 8-12 of the 88 CFA Level 2 exam questions or 2-3 of the 22-item sets focus on this topic.

| No. of Learning Modules | No. of Formulas |

|---|---|

| 6 | ca. 70 |

Syllabus, Readings, and Changes

The CFA Level 2 Portfolio Management (PM) syllabus encompasses 6 learning modules and 52 learning outcome statements. The Level 2 exam focuses on Exchange Trades, Market Risks, Investments, and Portfolio Management. Notably, for the 2025 exam, specific LOS from 2023 have either been consolidated into other readings or omitted.

Exchange-traded Funds: Mechanics and Applications

Exchange-traded funds (ETFs) were developed as an alternative to mutual funds based on the Modern Portfolio Theory discussed in the CFA curriculum. They have grown in popularity due to access, relatively low cost, transparency, and the diversity of available assets. ETFs are also typically more tax-efficient than mutual funds, making them more helpful in diversifying positions and portfolios.

The reading introduces the primary and secondary markets for ETFs and how ETFs are used effectively for portfolio development. You will also examine the risks and costs of ETFs and other important considerations for investors.

Using Multifactor Models

Multifactor models allow financial analysts to construct a more precise and nuanced view of risk than possible with a single-factor approach. This has made multifactor models a dominant investment practice for measuring and navigating risk.

The reading provides a background on the modern portfolio theory of multifactor models.You will be introduced to arbitrage pricing theory, various multifactor models, and their applications.

Measuring and Managing Market Risk

Market risk may mean fluctuations in stock prices, interest rates, exchange rates, or commodity prices. Risk management allows financial analysts to align risks with investment goals by classifying and measuring such risks. This is done through financial models, experience, and good judgment.

The reading provides a foundation for understanding and assessing Value at Risk (VaR). You will learn about the constraints in risk management and sensitivity measures used for equities, fixed-income securities, and options.

Backtesting and Simulation

Backtesting is the practice of simulating the performance of an investment strategy without risking capital. This allows financial analysts to test hypotheses using historical data to simulate results they can analyze for return. Backtesting and simulation have become increasingly popular in quantitative investing due to the rise in big data and other associated technological developments.

The reading introduces backtesting techniques. You will learn how these tools increase the usefulness of otherwise “random” data.

Economics and Investment Markets

Financial market activity is intimately interwoven with the overall state of the economy. Through financial markets, savers can defer consumption, providing governments and corporations greater access to capital.

The reading explores the connection between the real economy and financial markets and demonstrates the usefulness of economic analysis in the valuation of securities and their aggregates. You will review how the economy influences the prices of various forms of debt, equity, and credit.

Analysis of Active Portfolio Management

Modern portfolio theory (MPT) has its roots in the 1952 Markowitz framework. It has since evolved into the dominant framework for discussing and applying the principles of risk and return in portfolio management. Since 1952, various models, concepts, terminology, and mathematics have been combined with the Markowitz framework to create the MPT.

You are expected to have an understanding of basic portfolio theory (from Level 1) before reading in this section. The reading introduces the mathematics of “value-added” through active portfolio management, compares various risk measurements, and provides examples of active portfolio management strategies in equity and fixed-income markets.

Sample Questions and Answers

These sample questions are typical of the L2 exam’s complexity and depth – formatted as item sets, with a vignette to deliver a scenario that tests the CFA L2 exam curriculum. On the actual exam, each vignette applies to 4 questions. We’ve added a few additional ones for you to practice with. Be sure to review the illustrated explanations we’ve provided for each question. UWorld’s question bank is designed to expose you to exam-like questions and explain the concepts tested thoroughly.

Which of the following best describes the role of Broad Street as authorized participant?

- Facilitates the creation/redemption of ETF shares with the fund sponsor

- Is authorized by the fund sponsor to trade its ETF in the secondary market

- Buys shares of stock directly from the fund sponsor to create new ETF shares

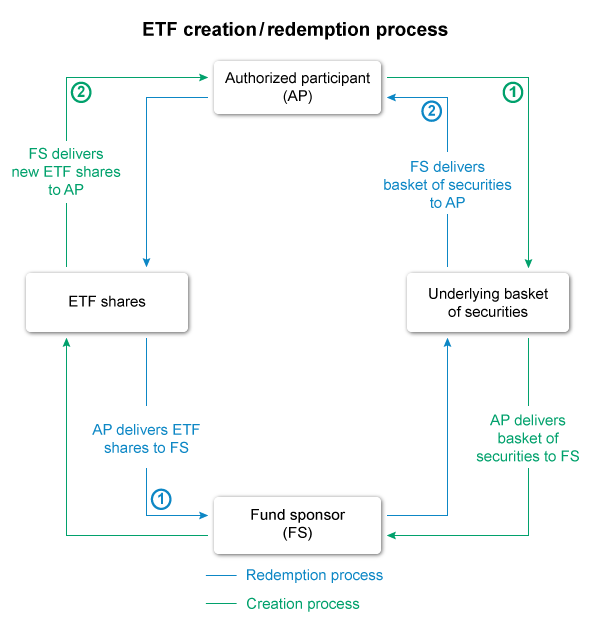

An authorized participant (AP) is a special type of market maker that has the right to create and redeem shares of an exchange-traded fund (ETF) in coordination with the fund sponsor (FS).

The AP initially works with the FS to bring the ETF to the primary market (ie, stock exchange). The AP initially buys a basket of securities (eg, $10,000,000 market value), which forms the ETF’s underlying basis, and delivers those shares to the FS in exchange for an equivalent value of ETF shares (eg, 500,000 shares at $20). The AP then sells the ETF shares to investors in the secondary market.

Once the ETF is created and is trading in the secondary market, the AP facilitates the in-kind creation and redemption of ETF shares with the FS, based on underlying investor demand.

(Choice B) Once listed on an exchange, the ETF can be traded by any broker/dealer like any other stock.

(Choice C) The AP buys the underlying securities directly from the market, not the fund sponsor, to create new ETF shares.

Things to remember:

An authorized participant is a special type of market maker that has the right to create and redeem shares of an exchange-traded fund in coordination with the fund sponsor.

An ETF creation unit is best described as stocks:

- included in the ETF that are publicly disclosed each day by the fund sponsor

- that the AP receives from the fund sponsor in exchange for shares of the ETF

- that the AP sends to the fund sponsor in exchange for large blocks of the ETF

| Exchange-traded fund (ETF) creation/redemption terminology | |

|---|---|

| Creation unit | A large in-kind transaction occurring only between the fund sponsor and authorized participant. |

| Creation basket | The basket of securities the authorized participant sends when creating an ETF. This list of securities is publicly disclosed each day. |

| Redemption basket | The basket of securities the authorized participant receives when redeeming an ETF. |

Creation units refer to large in-kind transactions that occur only between a fund sponsor and an authorized participant (AP). A typical transaction size for a creation unit is 50,000 ETF shares (eg, CETF) in exchange for a basket of securities (eg, shares of 10 technology stocks) of equal value.

(Choice A) The list of an ETF’s underlying securities that is publicly disclosed each day by the fund sponsor is the fund’s creation basket, not its creation unit.

(Choice B) The underlying securities that an authorized participant receives from the fund sponsor in exchange for shares of the ETF are the redemption basket. If the basket is large (eg, 50,000 ETF shares), it is called a redemption unit (ie, the opposite of a creation unit).

Things to remember:

Creation units refer to large in-kind transactions that occur only between a fund sponsor and an authorized participant. A typical transaction size for a creation unit is 50,000 ETF shares in exchange for a basket of securities of equal value.

Based on Exhibit 1, the presence of Company K in the redemption basket is most likely related to:

- representative sampling

- the quarterly rebalancing

- adding Company K to the ETF

Although creation and redemption baskets usually share the same constituent securities, the securities sometimes differ. Since most ETFs are passively managed,additions and deletions to the underlying security baskets are often related to the periodic (eg, quarterly) rebalancing of the index.

Having different baskets allows the fund sponsor to add or remove positions in the fund organically (ie, through normal trading activity), just as a traditional mutual fund would buy or sell securities to adjust the composition of a portfolio.

If there is not enough intraday trading activity to completely add or remove a position in the fund, an AP will make a finalizing trade using that day’s closing prices to minimize any potential tracking error versus the index.

(Choice A) Representative sampling refers to holding only a portion of the index constituents in the index ETF. This is common when an index has very small exposure to many names or the underlying securities are illiquid. An ETF holding the 10 largest technology companies in the US market (ie, very large liquid positions) would not be a candidate for representative sampling since any tracking error would be substantial.

(Choice C) Company K is being removed (ie, redemption basket) from the ETF; it is Company J is being added (ie, creation basket).

Things to remember:

Since most ETFs are passively managed, additions and deletions to the underlying security baskets are often related to the periodic rebalancing of the index.

Latest Changes in the Level 3 Curriculum

For the 2025 CFA Program Level 3, CFA Institute (CFAI) has introduced substantial enhancements and expansions, marking 1 of the most significant developments since the program’s inception. This year features the debut of specialized pathways in Private Wealth, Private Markets, and Portfolio Management, allowing you to tailor your learning to align closely with your career aspirations. Each pathway builds on a robust common core, enriched with specialized content designed to deepen expertise in your chosen area. As you delve into these new pathways, detailed descriptions of each can be found seamlessly integrated within our Level 3 curriculum topic outline guide.

Frequently Asked Questions (FAQs)

How hard does Portfolio Management get for the CFA Level 1 exam?

Portfolio Management (PM) on the CFA Level 1 exam varies in difficulty based on a candidate’s prior knowledge and experience. It is moderately challenging, building upon fundamental concepts from earlier sections. You need a basic understanding of theories and concepts such as diversification, asset allocation, and risk management. Familiarity with investment products and securities is important. To prepare, you should allocate ample study time, solve practice problems, and focus on grasping underlying theories. This builds a strong foundation and improves their chances of success.

How do I practice CFA Portfolio Management questions?

To prepare for CFA Portfolio Management questions, start by reviewing the curriculum and understanding the concepts. Solve practice questions from various sources, including CFA Institute, study materials, and online forums such as UWorld. Analyze your mistakes and learn from them. Practice time management by solving questions within the exam’s time limits. Focus on key topics including Financial Statement Analysis and Ethics, while allocating sufficient time to portfolio management. Seek feedback from study groups or a tutor to improve your study plan.

Is the CFA charter good for a career in Portfolio Management?

Yes. The CFA charter can be an excellent credential for a career in Portfolio Management. The CFA program provides a comprehensive and rigorous education in investment management, covering a wide range of topics such as ethics, financial analysis, economics, and portfolio management. Having the CFA charter demonstrates to employers and clients that you have a deep understanding of these concepts and are committed to ethical practices. It can also increase your marketability and career opportunities in the field of Portfolio Management, as the credential is highly respected within the industry.

Does the Portfolio Management topic get challenging in the CFA Level 2 exam?

Yes. The Portfolio Management topic gets more challenging in the CFA Level 2 exam compared to the CFA Level 1 exam. In Level 2, the Portfolio Management topic builds upon the foundational concepts introduced in Level 1 and includes more advanced concepts and techniques. In particular, Level 2 Portfolio Management covers topics such as asset allocation, risk management, and performance evaluation. The material is more quantitative, and you are expected to have a solid understanding of statistical concepts and financial modeling techniques. Additionally, the CFA Level 2 exam places a greater emphasis on the application and analysis of concepts, requiring you to be able to apply your knowledge in real-world scenarios. While Portfolio Management is not the most heavily weighted topic in the CFA Level 2 exam, it is still important and requires time and study effort.