The remaining 30-40% delves into various topics including different schools of economic thought, price indexes, business cycles, currency markets, exchange rates, and more. This distribution of topics maintains a consistent exam weighting across all levels of the CFA exam cycle.

| Economics | ||

|---|---|---|

| Topic Weight | Number of Questions | |

| Level 1 | 6%-9% | 11-16 |

| Level 2 | 5%-10% | 4-8 questions; 1-2 item sets |

What to Expect in CFA Level 1 Economics

In CFA Level 1 Economics, you will delve into fundamental micro- and macroeconomic principles that are essential for financial and investment analysis. Although Economics carries a weight of 6%-9% on the exam, which is relatively lower compared to Ethics and Financial Statement Analysis, it is equally important. Throughout this course, you will gain insights into crucial aspects of economic forecasting, top-down investment analysis, and bottom-up security selection strategies.

Exam WeightingThe CFA Economics topic has a weighting of 6%-9% of the L1 exam, so approximately 11-16 of the 180 exam questions focus on this topic.

No. of Learning Modules No. of Formulas| No. of Learning Modules | No. of Formulas |

|---|---|

| 8 | ca. 60 |

Level 1 Economics 2026 Syllabus, Learning Modules, and Changes

CFA Level 1 Economics’ syllabus spans 8 learning modules and contains 30learning outcome statements (LOS). The CFALevel 1 exam has minor updates to the overall structure for economics, with some reshuffling in the learning outcomes.

The Firm and Market Structures

Market structures are intimately tied to how firms price their products and their potential profitability. For example, long-term profits are typically decreased in highly competitive markets but still attainable in less competitive markets. Familiarity with the effects of various market forces is a boon to financial analysts when evaluating a firm’s short- and long-term prospects.

- The reading distinguishes between various market structure classifications and how each structure influences the outcomes of demand and supply relations.

- The reading also covers company competition and interaction in various market conditions, such as perfect competition, monopolistic competition, oligopoly, and pure monopoly.

Understanding Business Cycles

Typical business cycles and phases exist within economies despite their complexity. Understanding cycle phases aids the analyst in projecting how outcomes and decisions of individuals and firms affect the performance of sectors and companies.

- The reading familiarizes you with the business cycle and its phases and how various economic factors fluctuate accordingly.

- The reading also elaborates on methods to interpret a set of economic indicators and covers measurements of inflations.

Monetary and Fiscal Policy

Governments in developed countries have an outsized impact on their economies due to the size of the workforce they employ and of their fiscal budgets. This influence is augmented by taxation and spending decisions (fiscal policy)and a central bank’s influence over credit and the quantity of money (monetary policy).

- The reading introduces how money is created, the role of central banks, and various theories regarding the demand for and supply of money.

- The reading also distinguishes between expansionary and contractionary monetary policies and the advantages and disadvantages of various tools for implementing fiscal policies.

Introduction to Geopolitics

Geopolitics is closely related to globalization, as the interconnectedness of the world’s economies and political systems has increased in recent decades. This has led to cooperation and competition between countries as they seek to advance their own interests in an increasingly interconnected world.

- The reading analyzes geopolitics from the perspective of cooperation versus competition.

- The reading also assesses geopolitics and its relationship with globalization, explores tools of geopolitics and their impact on regions and economies, and analyzes geopolitical risk and its impact on investments.

International Trade and Capital Flows

The attractiveness of a global investment may depend on a particular country’s economic robustness, price stability or interest rates, the strength of a specific sector or industry, GDP growth rates, trade policies, demographics, human capital, etc.

- The reading explores the benefits of international trade and describes the dynamics of trading blocs, common markets, and economic unions.

- The reading also explains how international financial organizations influence and facilitate international trade and the implications of various trade and capital restrictions.

Currency Exchange Rates

The global economy is becoming increasingly interwoven, and this integration is impossible without currency exchange. As a result, the foreign exchange market (FX) is the largest market on the planet. Furthermore, purely domestic portfolios are not exempt from the influences of globalization, making an understanding of foreign exchange critical for any financial analyst.

- The reading explores exchange rate mechanics and familiarizes with major players.

- The reading also covers alternative exchange rate regimes and how exchange rates influence a country’s imports, exports, and capital flows.

CFA Economics Level 1 Sample Questions and Answers

These sample questions are typical of the probing multiple-choice questions on the L1 exam. During the exam, you have about 90 seconds to read and answer each question, carefully designed to test knowledge from the CFA Curriculum. UWorld’s question bank will expose you to exam-like questions and thoroughly illustrate the concepts tested.

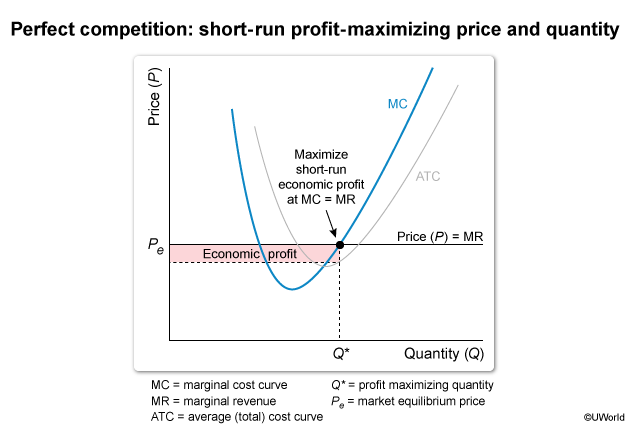

In the short run, a company maximizing profit in a market with perfect competition produces at a quantity that most likely results in:

- economic profits equal to zero.

- marginal revenue equal to marginal cost.

- market price greater than marginal revenue.

A firm operating under perfect competition maximizes economic profit by producing and selling at the quantity where marginal revenue (MR) equals marginal cost (MC). Cost in this context includes opportunity costs (eg, the owners’ required return from the business). Perfectly competitive firms can earn economic profits in the short run, but even if economic profits are zero or negative, a firm may be earning an accounting profit.

MR, the incremental revenue from selling one additional unit, depends on the firm’s demand curve. In the case of perfect competition, the demand curve for any individual firm is a horizontal line at the market equilibrium price, since demand is perfectly elastic. Therefore, market price equals MR at all quantities (Choice C).

MC, the incremental cost to produce one additional unit, depends on the firm’s cost structure. Producing at a quantity greater than where MR = MC means that the incremental cost for each unit exceeds the incremental revenue generated by that unit and the firm generates a loss on each additional unit sold. Producing at a lower quantity means that the firm forgoes economic profit (in the short run) since the additional revenue from a unit sold would exceed the cost of the unit.

(Choice A) Perfectly competitive firms can earn economic profits in the short run. However, in the long-run, the positive economic profits will attract new firms, which will increase supply/lower price until economic profit is zero.

Note: Although this question specifically addresses perfect competition, the condition that firms optimally produce when MR = MC applies to all market structures. It is likely that the exam will have questions on this topic.

Things to remember:

Under perfect competition, a firm maximizes short-run economic profit by producing and selling at the quantity where marginal revenue (MR) equals marginal cost (MC). Since there is perfectly elastic demand, price also equals MR for all quantities. Short-run, but not long-run, economic profits are possible. However, a firm may earn an accounting profit even if economic profits are zero or negative.

Copyright © UWorld. All rights reserved.

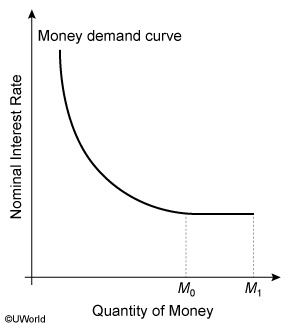

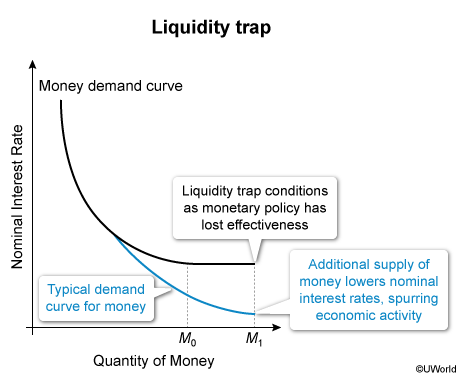

A demand curve for money is depicted in the graph below:

Which of the following best explains the shape of the curve between M 0 and M 1?

- Liquidity trap

- Policy rate of zero

- Neutral rate of interest

There are limits to the effectiveness of monetary policy. This is often true in a deflationary environment when the demand curve for money becomes horizontal (ie, infinitely elastic), as shown in the graphs above. A liquidity trap occurs when the quantity of money continues to expand but fails to lower interest rates since economic agents would rather hold cash than borrow or lend. At this point, monetary policy stops stimulating economic activity and loses its effectiveness.

A central bank’s monetary policy tools depend on others to implement them. For example, a central bank can lower interest rates or reduce reserve requirements but cannot force anyone to borrow or lend. A liquidity trap is an example of such ineffectiveness.

The economist John Maynard Keynes is credited with coining the phrase “pushing on a string” to describe the limitations of monetary policy. It is easy to visualize how pulling on a string can bring something closer and how pushing on a string has no effect since it crumples and goes nowhere. In a liquidity trap, the central bank is effectively “pushing on a string.”

(Choice B) Central bank policy is not constrained by the zero boundary; policy rates can and have been negative. The demand for money does not necessarily stagnate at a zero-bound policy rate.

(Choice C) The neutral rate of interest is the central bank’s policy rate that neither slows nor accelerates economic activity and is not specifically associated with the money demand curve.

Things to remember:

A liquidity trap results when the demand curve for money is horizontal and infinitely elastic, which often occurs in a deflationary environment. In a liquidity trap, monetary policy stops stimulating economic activity and loses its effectiveness.

Copyright © UWorld. All rights reserved.

A currency trader observes the following currency spot exchange rates from two dealers:

| Source | Currency | Exchange Rate |

|---|---|---|

| Dealer 1 | CNY/THB | 0.22 |

| Dealer 1 | INR/THB | 2.35 |

| Dealer 2 | INR/CNY | 10.75 |

Based on only this information, the arbitrage profit available per every CNY 1 is closest to:

- INR 0.0682

- INR 0.0064

- CNY 0.0682

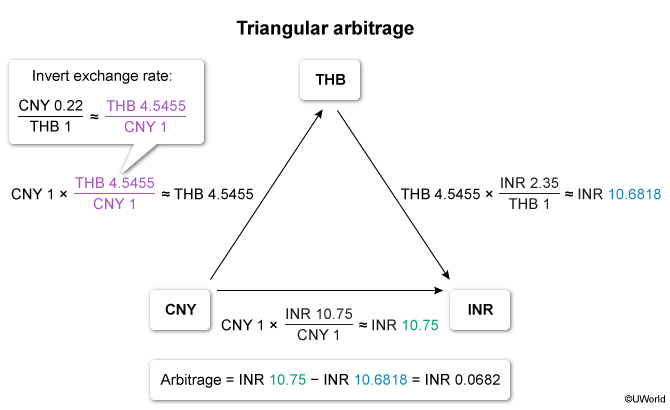

A cross-rate is the exchange rate implied by two related exchange rates, assuming that no arbitrage opportunities exist. If the actual exchange rate differs from the no-arbitrage exchange rate implied by the cross-rate, then an arbitrage opportunity exists. An investor can profit by purchasing a currency from the source where it is underpriced and simultaneously selling the same currency to the source where it is overpriced.

Finding an arbitrage opportunity from cross-rates can be conceptualized as a triangle, as shown above. Potential arbitrage profits can be observed by moving from one currency to another in two directions around the triangle. When moving around the triangle, one currency is multiplied by the actual exchange rate to convert to another currency.

In this scenario, the INR/CNY rate from Dealer 2 is 10.75. Using the INR/THB and CNY/THB rates quoted by Dealer 1, Dealer 1’s INR/CNY cross-rate is 10.6818. The arbitrage profit is the difference between buying CNY 1 for INR 10.6818 from Dealer 1 and simultaneously selling CNY 1 for INR 10.75 to Dealer 2. The profit is INR 10.75 − INR 10.6818 = INR 0.0682 per every CNY 1 (Choice C).

(Choice B) 0.0064 is the potential arbitrage profit in CNY, not INR.

Things to remember:

If an actual exchange rate differs from a cross-rate derived from two related exchange rates, an arbitrage

opportunity becomes available by purchasing a currency from the underpriced source and selling the same currency to

the overpriced source.

Copyright © UWorld. All rights reserved.

What to Expect in CFA Level 2 Economics?

At 5-10% of the total exam content, CFA Level 2 Economics is less heavily weighted than about half of the topics on the Level 2 exam and contains only 1 study session. The topic readings focus on foreign exchange concepts and theories of exchange rate determination. You will explore 3 theories of growth and how regulation affects particular industries.

Exam Weighting

The CFA Economics topic has a weighting of 5-10% of the L2 exam content, meaning that approximately 4-8 item set questions or 1-2 item sets focus on this topic.

| No. of Learning Modules | No. of Formulas |

|---|---|

| 3 | ca. 50 |

Level 2 Economics 2026 Syllabus, Readings, and Changes

The CFA Level 2 Economics syllabus will remainthe same in 2026 and has no substantive changes from prior readings.

| No. of Learning Modules:3 | No. of LOS :34 |

|---|---|

|

Introduces fundamental foreign exchange concepts and theories of exchangerate determination.Discusses 3 theories of growth and concludes with an overview of the regulation and its effecton industries. |

|

Currency Exchange Rates: Understanding Equilibrium Value

Exchange rate fluctuations are known to be unpredictable. Therefore, financial analysts are better off understandinglong-run equilibrium value, risk exposure, and currency hedges.

- The reading reviews fundamental theories and important influences regarding currency equilibrium dynamics.

- The reading also explores international parity conditions and how to calculate important variables related tolong-term currency value.

Economic Growth

Global investors are concerned with forecasts of long-term economic growth. To develop global portfolio strategies,investors must become familiar with identifiers of long-term sustainable growth. You will explore factors that drivelong-term growth and that may be predictive of success or failure.

- The reading discusses the possibility of developing countries catching up with developed countries in thelong-run and how policies affect sustainable growth rates.

Economics of Regulation

Regulations are developed and implemented when market solutions can’t adequately address an issue. These regulationsinfluence national economies, companies, and individuals.

- The reading discusses the reasoning behind regulation, its role in ensuring market fairness, and its costs andbenefits.

- The reading also reveals the tools regulators use domestically and internationally.

CFA Economics Level 2 Sample Questions and Answers

These sample questions mirror the complexity and depth of the Level 2 exam. They are presented as item sets,accompanied by a vignette, which assesses your knowledge of the CFA Level 2 Curriculum. Please note that eachvignette corresponds to 4 questions on the actual exam. We have included a few extra questions to enhance yourlearning experience.

Make sure to review the detailed answer explanations provided for each question. UWorld’s question bank willfamiliarize you with exam-style questions and provide comprehensive explanations for the tested concepts.

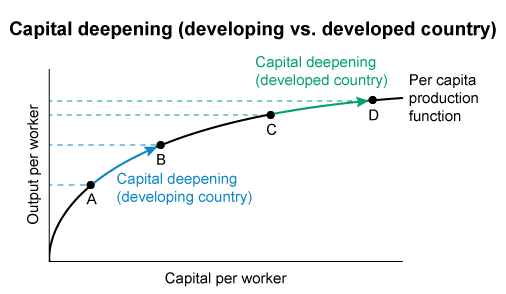

Saito wishes to identify how capital deepening will affect each country’s per capita output growth. Based on the neoclassical model, which of the following factors is most appropriate for Saito to consider?

- Capital-to-labor ratio

- Steady-state GDP growth

- Average hours worked per worker

Capital deepening is an increase in a country’s capital per worker (ie, capital-to-labor ratio). When workers gain more capital, they traditionally become more productive. However, the neoclassical model of economic growth states that the per capita production function, which measures capital per worker against output per worker, exhibits diminishing marginal returns. Therefore, when a country has a greater capital-to-labor ratio, it will likely see a smaller per capita output increase from capital deepening than if it had a lesser capital-to-labor ratio, all else equal.

(Choice B) Steady-state GDP growth considers several factors, including capital growth, labor growth, capital and labor as a percentage of total factor cost, and total factor productivity. Therefore, this measure would not be the most appropriate to identify how capital deepening will affect each country’s growth in output per capita.

(Choice C) Average hours worked per worker affects the factor of labor, not capital, when calculating economic output. Therefore, this measure would not be the most appropriate to use when specifically identifying how capital deepening will affect each country’s growth in output per capita.

Things to remember:

Capital deepening is an increase in a country’s capital per worker. In the neoclassical model, the per capita production function has diminishing returns. Therefore, a country with a greater capital-to-labor ratio will likely see a smaller output increase from capital deepening than a country with a lesser capital-to-labor ratio.

Copyright © UWorld. All rights reserved.

Based on Exhibit 1 and the growth-accounting equation, Country 1’s potential GDP closest to:

- 2.9%

- 3.5%

- 4.9%

| Exhibit 1 Select Economic Data. 20X4 | |||

|---|---|---|---|

| Country 1 | Country 2 | Country 3 | |

| Total physical capital ($ billions) Year-on-year (YoY) growth |

2,000 | 300 | 4,500 |

| 1.7% | 2.9% | 2.0% | |

| Labor force (millions) YoY growth |

16 | 9 | 45 |

| 0.5% | 3.4% | 0.8% | |

| Total hours worked (millions) YoY growth |

30,000 | 16,000 | 78,000 |

| 1.2% | 3.6% | 0.6% | |

| GDP ($ billions) YoY growth |

1,600 | 150 | 4,050 |

| 3.5% | 6.2% | 2.8% | |

| Steady state GDP growth (YoY) | 3.2% | 4.1% | 2.5% |

| Total factor productivity growth (YoY) | 2.0% | 0.7% | 1.6% |

| Share of output paid to capital | 65% | 85% | 70% |

Growth accounting equations to calculate % change in output (Δ Y /Y )

| Growth accounting equation: |

Δ A

/

A

+ α

Δ K

/

K

+ (1 – α )

Δ L

/

L

|

| Labor productivity growth accounting equation: |

Δ L

/

L

+ Long-term labor productivity growth rate

|

|

Δ A

/

A

= Growth rate of total factor productivity

|

α = Share of output paid to capital |

|

Δ K

/

K

= Growth rate of capital

|

Δ L

/

L

= Growth rate of labor

|

Growth accounting analyzes the economic growth of a country by attributing growth to unique components. The growth accounting equation, which is based on the two-factor production function, uses labor and capital as its two factors, with total factor productivity (ie, technological progress) as a residual (ie, exogenous) factor. The labor productivity growth accounting equation simplifies this equation by combining capital deepening and total factor productivity into a labor productivity growth rate.

Growth accounting equations measure a country’s capacity for sustainable economic growth (ie, potential GDP). Faster growth risks increasing the country’s inflation rate. In this scenario, the potential GDP growth rate for Country 1 is calculated as:

0.02 + (0.35)(0.017) + (0.65)(0.012) ≈ 0.034

The share of output paid to capital (α) is the elasticity of output with respect to capital. A 1% increase in capital will increase output by α%, calculated as the ratio of capital income (ie, Marginal product of capital × Amount of capital) to output (ie, GDP). The same applies to labor (1 −α).

(Choice A) 2.9% results from using the change in labor force in the calculation instead of the change in total hours worked. The change in total hours worked more accurately measures the contribution of labor to changes in output.

(Choice C) 4.9% results from adding changes in capital, total hours worked, and total factor productivity. It fails to account for the relative shares of output paid to capital (ie, 65%) and labor (ie, 35%).

Things to remember:

Growth accounting analyzes the economic growth of a country by attributing growth to unique components. The two-factor production model uses labor and capital as its two factors, with total factor productivity as a residual.

Copyright © UWorld. All rights reserved.

Based on Exhibits 1 and 2, all else equal, which country will most likely realize the greatest percentage increase in potential GDP from investments in health care?

- Country 1

- Country 2

- Country 3

| Exhibit 1 Select Economic Data. 20X4 | |||

|---|---|---|---|

| Country 1 | Country 2 | Country 3 | |

| Total physical capital ($ billions) | 2,000 | 300 | 4,500 |

| Year-on-year (YoY) growth | 1.7% | 2.9% | 2.0% |

| Labor force (millions) | 16 | 9 | 45 |

| YoY growth | 0.5% | 3.4% | 0.8% |

| Total hours worked (millions) | 30,000 | 16,000 | 78,000 |

| YoY growth | 1.2% | 3.6% | 0.6% |

| GDP ($ billions) | 1,600 | 150 | 4,050 |

| YoY growth | 3.5% | 6.2% | 2.8% |

| Steady state GDP growth (YoY) | 3.2% | 4.1% | 2.5% |

| Total factor productivity growth (YoY) | 2.0% | 0.7% | 1.6% |

| Share of output paid to capital | 65% | 85% | 70% |

| Exhibit 2 Country-related Institutional Factors | |

|---|---|

| Country 1 |

|

| Country 2 |

|

| Country 3 |

|

Countries can improve economic growth by investing in human capital, which is the knowledge that workers gain through formal education, on-the-job training, or other relevant experience. Investments in human capital can be expensive for both countries and companies, but these investments often pay off since:

- the workforce becomes more productive,

- more highly educated workers improve the productivity of those around them, and

- a more educated workforce results in more innovation, which results in a faster pace of growth in technological progress.

Residents of developing countries, on average, have lower life expectancies than residents of developed countries. Developing countries will therefore see the largest benefit (ie, increase in output) from investing in their health care systems, allowing workers to remain in the workforce longer. Workers who live longer are also able to accumulate more knowledge, improving the human capital of the country’s workforce.

In this scenario, Country 2 is most likely a developing country due to economic and other factors, including:

- Low per capita GDP

- Low capital per worker

- Limited property rights

- Poor education infrastructure

- Political instability

Therefore, all else equal, Country 2 would likely experience the greatest benefit from investments in health care (Choices A and C).

Things to remember:

Countries can improve their economic growth by investing in human capital, which can be expensive but often has significant payoffs. On top of education and training, developing markets can invest in human capital through improved health care systems, allowing workers to remain in the workforce longer and accumulate more knowledge.

Copyright © UWorld. All rights reserved.

What to Expect in CFA Level 3 Economics?

CFA Level 3 does not include a dedicated stand-alone Economics topic area, but Economics concepts still appear within Portfolio Management, Capital Market Expectations, global macro analysis, currency management, and scenario-based constructed-response questions.

How to Study CFA Economics (Levels 1–3)

Focus on Logic Instead of Memorizing Formulas

Economics on the CFA exam is driven by logic rather than rote memorization. Instead of trying to memorize formulas, focus on understanding the reasoning behind economic principles. As you study, apply concepts to real-world examples—such as why prices differ between cities or how interest rates affect currencies—to strengthen your conceptual foundation.

Learn to Interpret Graphs

Graphs rarely appear directly on the CFA exam, but the scenarios they illustrate appear frequently. Treat graphs as visual representations of real economic situations and practice interpreting what happens when curves shift or variables change. This approach makes it easier to solve conceptual and analytical questions during the exam.

Strengthen Your Skills with QBanks and Mock Exams

Consistent practice is essential to mastering CFA Economics. Use QBanks to test your understanding, identify weak areas, and reinforce learning through repetition. Completing mock exams and timed practice sets helps build exam stamina and improves your ability to interpret Economics questions quickly and accurately.

Focus on Understanding Core Economic Theories

Many Economics questions involve foundational concepts such as growth models, regulation, GDP, inflation, unemployment, and trade flows. While some calculations may be required, the exam emphasizes understanding why economic relationships behave as they do. A solid grasp of theory helps you solve both straightforward and complex scenarios across all levels.

Give Extra Attention to Currency Exchange Topics

Currency exchange is one of the more challenging areas of CFA Economics, especially at Levels 2 and 3. Concepts such as carry trades, interest rate parity, and no-arbitrage conditions can feel counterintuitive for many candidates. Spend additional time learning how currency markets work, as these topics appear frequently and influence multiple sections of the exam.

For more information, visit our CFA Level 1 Study Schedule, Level 2 Study Schedule and Level 3 Study Schedule

Frequently Asked Questions

Whether you have a finance or economics background, Economics is a core topic across all three CFA exam levels. Level 1 introduces foundational concepts that form the basis for Level 2 and Level 3, so mastering Level 1 Economics significantly improves your chances of success in the higher levels.

- Be Flexible with your Expectations: There are a lot of

concepts that need to be clarified and discussed. Once you’ve grasped these, you’ll notice several recurring

motifs in various situations. - Aim to Understand the Logic: This is not a topic for

memorizing. - Study the Graphs: While graphs aren’t usually on the

exam, their reasoning is. Consider the graphs as a visual representation of a real-world situation. - Apply Concepts in Different Situations with Practice Questions: This is a crucial stage

in the learning process that must be completed at the end of

each study session.

Practice is one of the most effective ways to prepare for the CFA tests. Always review the multiple-choice questions (MCQs) at the end of each CFA Institute learning module. UWorld’s all-digital learning platform assists students in passing the CFA exams by offering practice problems with detailed rationales for all answer alternatives, step-by-step problem-solving instructions, and realistic, professionally produced graphics.

It is essential to grasp the process of formulating equations, as this comprehension greatly enhances formula memorization. Understanding the underlying logic or methodology behind a mathematical formula significantly improves your ability to recall it. UWorld’s SimpleSheets offer the necessary formulas for exam success in a user-friendly, intuitive format that is readily accessible. Our ReadyDeck flashcards, included with all of our products, already contain pre-filled formulas. You can download our CFA Level 1 formula sheet to access these resources.

Economics is a central topic on all 3 levels of the CFA exams that requires some effort to study, particularly the exchange rate segment. Because it penetrates all other areas, a strong CFA Level 1-2 Economics foundation is crucial to enhancing your chances of passing CFA Level 3.

Economics is tested at every level of the CFA Program, with Level 1 focusing on foundational concepts, Level 2 emphasizing applied analysis and currency topics, and Level 3 integrating global macroeconomics into portfolio management. A strong understanding of Economics strengthens performance across multiple subjects including fixed income, equity, and portfolio management.

Economics typically represents 8–12% of Level 1 multiple-choice questions, 5–10% of Level 2 item sets, and a smaller but still meaningful portion of Level 3’s portfolio management and constructed-response tasks. The exact number varies each exam cycle, but Economics remains a consistent component across all levels.

The CFA Economics syllabus includes microeconomics, demand and supply, elasticity, market structures, macroeconomic indicators, inflation, unemployment, business cycles, monetary and fiscal policy, international trade, exchange rates, economic growth models, and the impact of economic variables on investment decisions at each level.

Key Level 1 topics include market equilibrium, elasticity, inflation and unemployment, GDP and economic indicators, monetary and fiscal policy, trade theory, exchange-rate basics, purchasing power parity, and economic growth models. These foundational concepts prepare candidates for more advanced applications at Level 2 and Level 3.

Level 2 Economics emphasizes exchange rates, currency forecasting, economic growth theory, international capital flows, business cycle effects, and macroeconomic forecasting. Candidates must apply these concepts in item-set formats that require deeper interpretation and scenario analysis.

At Level 3, Economics is integrated into macroeconomic expectations, asset allocation decisions, global trade dynamics, long-term economic trends, and how business cycles affect portfolio strategy. Questions often appear within portfolio management readings and constructed-response problems.

Economics includes formulas such as interest rate parity, exchange rate calculations, growth models, and elasticity equations, but the CFA exam tests conceptual understanding more than pure memorization. Most questions require interpreting economic scenarios rather than performing heavy calculations.

The best approach is to focus on understanding fundamental economic logic, study graphs and models, complete consistent practice questions, review formulas regularly, and connect concepts to real-world scenarios. Applying concepts through practice is essential for long-term retention and higher exam performance. Start your cfa free trial today.

No formal Economics background is required. The CFA curriculum introduces all major Economic concepts from the ground up, but having basic familiarity with macro and micro principles can make Level 1 easier and improve overall progression through Levels 2 and 3.