CFA® Level 1 Exam Blueprint

Understanding the Exam's Fundamental Topics

While formulating a concrete plan for your Level 1 preparation, familiarizing yourself with the CFA Level 1 exam topics is of great importance. And irrespective of the level that you are studying for, curriculum updates naturally become one of the most important things to keep an eye out for. Because the CFA Institute (CFAI) is known for making frequent (usually yearly) changes to the curriculum, always refer to the most recent versions.

CFA Level 1 Exam Topics

The CFA Level 1 exam evaluates your understanding of 10 distinct subject areas, with Economics, Ethics, Quantitative Methods, and Financial Reporting being given significant weight. The table below provides information on the number of readings, weights, and questions associated with each of the ten topics.

| CFA Level 1 Topics Overview | |||

|---|---|---|---|

| Topics | Weight | No. of Learning Modules |

No. of Questions |

| Ethical and Professional Standards | 15-20% | 5 | 27-36 |

| Quantitative Methods | 6-9% | 11 | 11-16 |

| Economics | 6-9% | 8 | 11-16 |

| Financial Statement Analysis | 11-14% | 12 | 20-25 |

| Corporate Issuers | 6-9% | 7 | 11-16 |

| Fixed Income | 11-14% | 19 | 20-25 |

| Portfolio Management | 8-12% | 6 | 15-21 |

| Equity Investments | 11-14% | 8 | 20-25 |

| Derivatives | 5-8% | 10 | 9-14 |

| Alternative Investments | 7-10% | 7 | 13-18 |

The CFA Level 1 exam covers a broad range of topics related to investment management and financial analysis. These topics are divided into four functional areas:

- Ethical and Professional Standards

- Ethics and Trust in the Investment Profession

- Code of Ethics and Standards of Professional Conduct

- Guidance for Standards I–VII

- Introduction to the Global Investment Performance Standards (GIPS)

- Ethics Application

- Quantitative Methods

- Rates and Returns

- Time Value of Money in Finance

- Statistical Measures of Asset Returns

- Probability Trees and Conditional Expectations

- Portfolio Mathematics

- Simulation Methods

- Estimation and Inference

- Hypothesis Testing

- Parametric and Non-Parametric Tests of Independence

- Simple Linear Regression

- Introduction to Big Data Techniques

- Economics

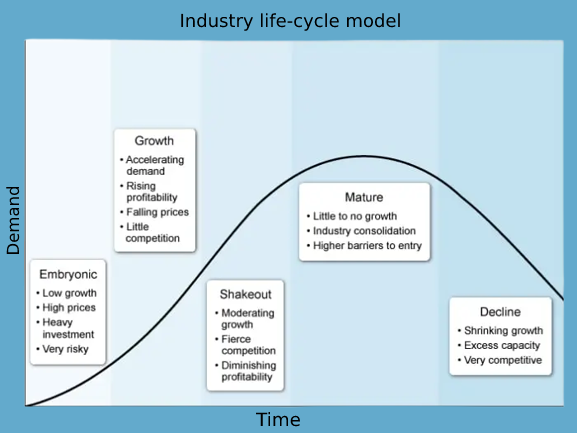

- The Firm and Market Structures

- Understanding Business Cycles

- Fiscal Policy

- Monetary Policy

- Introduction to Geopolitics

- International Trade

- Capital Flows and the FX Market

- Exchange Rate Calculations

- Financial Statement Analysis

- Introduction to Financial Statement Analysis

- Analyzing Income Statements

- Analyzing Balance Sheets

- Analyzing Statements of Cash Flows I

- Analyzing Statements of Cash Flows II

- Analysis of Inventories

- Analysis of Long-Term Assets

- Topics in Long-Term Liabilities and Equity

- Analysis of Income Taxes

- Financial Reporting Quality

- Financial Analysis Techniques

- Introduction to Financial Statement Modeling

These functional areas are further divided into 10 study sessions that cover specific topics within each area. The topics are designed to provide candidates with a comprehensive understanding of the investment management process and the various factors that affect investment decisions.

The Level 1 exam consists of 180 multiple choice questions, split between two 135-minute sessions (session times are approximate). There is an optional break between sessions.

- Morning Session (2 hours, 15 minutes): 90 multiple choice questions, covering the topics of ethics & professional standards, quantitative methods, economics, and financial statement analysis

- Afternoon Session (2 hours, 15 minutes): 90 multiple choice questions, covering the topics of corporate issuers, equity, fixed income, derivatives, alternative investments and portfolio management.

Overview of CFA Level 1 Exam Subjects

Before beginning your studies, ensure that you meet all the CFA exam requirements. As part of the CFA evolution 2024 updates, certain Level 1 curriculum content has been moved to pre-read materials. This includes topics such as the time-value of money, basic statistics, microeconomics, and an introduction to company accounts. This change has been implemented to prevent duplication and save time during the exam.

[5 Learning Modules | No formulas]

Ethical and Professional Standards is a crucial component of the CFA Program curriculum across all three levels, and therefore, it is essential to thoroughly comprehend this material. The CFAI places significant importance on Ethical and Professional Standards and even utilizes scores from this section to determine if a candidate passes or fails if their overall exam score is on the borderline of the Minimum Passing Score (MPS). This topic is favored by the CFAI, with around 15 to 20% of the total weight allocated to it, so you should be prepared to dedicate a substantial amount of time to studying all the Ethical and Professional Standards materials. Read more on this topic at the Ethical and Professional Standards page.

[11 Learning Modules | 100 formulas]

Quantitative Methods (QM) is a subject that many candidates find intimidating, and it comprises approximately 6 to 9% of the total weight of the Level 1 exam. This course covers analytical tools and discounted cash flow analysis, which form the basis for security and asset valuation. Additionally, it covers their use in quantifying risk in investment decision-making. For a much more detailed read, visit the Quantitative Methods page.

[8 Learning Modules | 60 formulas]

The key focus of this topic is to develop a foundational understanding of micro and macroeconomic principles, such as supply and demand analysis, different market structures, economic growth, and business cycles, and how they affect economic activity. Our Economics page contains a thorough discussion of each reading. Economics accounts for 6 to 9% of the Level 1 exam.

[12 Learning Modules| 100 formulas]

On the Level 1 exam, FSA is the second most significant topic, making up around 11 to 14% of the exam's total weight. Apart from understanding how to analyze and interpret primary financial statements, you need to be acquainted with ratios and concepts like revenue recognition, long-term assets, and taxes. Visit our page on Financial Statement Analysis for a much more in-depth understanding of the subject.

[7 Learning Modules | 40 formulas]

Corporate finance (CI) is an essential section of the CFA exam, encompassing critical topics such as capital budgeting, cost of capital, leverage, and working capital management. This section holds a weight of around 6 to 9% on the exam and provides an overview of corporate governance and investment and financing options. For a lot more specific information, visit the Corporate Issuers page.

[19 Learning Modules | 40 formulas]

In the FI section of the CFA exam, it is essential for candidates to comprehend the attributes of different types of Fixed Income securities and learn how to determine their value. Key concepts include yield measures, duration, and convexity. Fixed income questions make up roughly 11-14% of the exam.For more insights into the topic, visit the Fixed Income page.

[6 Learning Modules | 50 formulas]

Portfolio management (PM) involves the strategy of investing in a collection of assets, rather than individual assets, to achieve an advantage. Portfolios provide substantial benefits in risk diversification, allowing for a reduction in risk without sacrificing returns. The topic of portfolio management makes up around 8 to 12% of the Level 1 exam. The key principles to understand in this area are Modern Portfolio Theory and the Capital Asset Pricing Model, which are also relevant for the Level 2 and 3 exams. Detailed information is available on the Portfolio Management page.

[8 Learning Modules | 50 formulas]

The EV section of the CFA curriculum is dedicated to topics such as equity markets and instruments, as well as various valuation techniques and tools. This section is of utmost importance as it lays the groundwork for the higher levels of the CFA Program. In the Level 1 exam, the EV questions carry a weightage of approximately 11 to 14% of the total exam. Please visit the page on Equity Valuation for much more in-depth information.

[10 Learning Modules | 40 formulas]

In the CFA Level 1 exam, Derivatives and Portfolio Management are introduced as new topics. Candidates are assessed on their knowledge of the basic principles of futures, forwards, swaps, options, and derivative hedging techniques. The Derivatives section, along with Portfolio Management, carries a relatively low weight of 5 to 8% in the exam. Visit the Derivative Investments page for more information.

[7 Learning Modules | 10 formulas]

Alternative investments refer to investments that are used in addition to the traditional stock, bond, and cash positions. The five primary areas of alternative investments include hedge funds, private capital, natural resources, real estate, and infrastructure. In the Level 1 curriculum, the Alternative Investments section is introductory and carries an exam weight of 7 to 10%. Want to know more about the topic? Visit the Alternative Investments page.

The Important, Straightforward, and Hardest Topics of Level 1 Exam

New candidates often ask whether they need to follow the prescribed order of study for the CFA Level 1 exam and if all subjects should be given equal attention. They also wonder if there are any topics that require extra attention, what they should know before diving into a subject, and whether they need to spend extra time re-reading the topics. While the difficulty of exam topics can be subjective, historical candidate performance data is the deciding factor for which topics are most complex or straightforward.

Therefore, it is advisable to follow the recommended study order, but you should also allocate additional study time to the topics with lower historical pass rates. It's also essential to have a solid understanding of the prerequisites before diving into a new topic, and you may need to dedicate extra time to re-reading the material to reinforce your knowledge.

Even though all the topics and their preparation are equally important to passing the Level 1 exam, there are some that might need a bit extra attention.

- Ethics – The Ethics section of the CFA Level 1 exam is notoriously challenging due to its subjective nature. Questions in this section cannot be easily quantified, making it difficult for many candidates to succeed. A thorough understanding of ethical concepts and their real-world application is essential to accurately analyze and answer these questions.

- Financial Statement Analysis – The Level 1 exam places a strong emphasis on Financial Statement Analysis (FRA), requiring candidates to learn a significant amount of terminology and understand the fundamental concepts. In fact, 26 of the 180 questions on the 2023 CFA Level 1 exam will be related to FRA, making it one of the most heavily tested topics. Apart from the Ethics and Professional Standards section, no other topic on the Level 1 exam is tested with such rigor.

- Quantitative Methods – Quantitative Methods (QM) is a crucial topic for the CFA Level 1 exam, covering important areas such as the time value of money, probability concepts, descriptive statistics, and statistical inference. Additionally, many quantitative tools used in other Level 1 topics are rooted in QM. Mastery of this topic is essential for success on the exam.

The CFA Level I exam covers a broad range of topics related to investment management and financial analysis. Based on historical pass rates, the hardest topics for the CFA Level I exam are:

- Financial Reporting and Analysis: This topic has consistently been one of the most challenging for candidates, with a historical pass rate of around 45-55%. FRA covers a wide range of financial accounting and financial statement analysis concepts, including revenue recognition, inventory analysis, and financial ratios.

- Quantitative Methods: QM is another challenging topic, with a historical pass rate of around 50-60%. This topic covers a range of quantitative concepts, including time value of money, probability, and statistical concepts and methods.

- Economics: Economics has a historical pass rate of around 55-65%. This topic covers macroeconomic and microeconomic concepts, including supply and demand analysis, market structures, business cycles, and monetary and fiscal policy.

It is important to note that pass rates can vary from year to year and can be influenced by factors such as the difficulty level of the exam and the performance of the candidate pool. Candidates should focus on mastering all of the topics in the CFA Level I curriculum to maximize their chances of success on the exam.

It’s difficult to identify the easiest topics for the CFA Level 1 exam based solely on pass rates, as pass rates can be influenced by various factors such as the difficulty level of the questions, the number of candidates taking the exam, and the candidates’ individual strengths and weaknesses. That being said, historically, some of the topic areas with higher pass rates on the CFA Level 1 exam include:

- Corporate Finance

- Equity Investments

- Fixed Income

- Portfolio Management

These topic areas tend to be more straightforward and can be easier to understand for candidates with a strong background in finance and accounting. However, it’s important to note that each candidate’s experience may differ, and it’s crucial to have a well-rounded understanding of all the topic areas covered on the exam to increase the chances of success. It’s recommended that candidates allocate study time and effort proportionally across all the topic areas to ensure comprehensive preparation.

Analyzing CFA Level 1 Topics

What topics should I study first for CFA Level 1?

The CFA Level 1 exam covers 10 broad topic areas, which are further grouped into four functional areas. The recommended order of studying these topics may vary depending on personal preferences and study styles. However, here is one possible suggested order of studying the 10 CFA Level 1 topics:

- Ethics and Professional Standards

- Quantitative Methods

- Economics

- Financial Statement Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management

It is important to note that while the order of studying the topics may vary, it is recommended to allocate sufficient time to cover each topic thoroughly and practice questions regularly to reinforce learning.

Which topics require the most calculator usage for the CFA Level 1 exam?

The CFA Level 1 exam covers a broad range of topics, and a financial calculator is required to perform various calculations on many of these topics. The topics that require the most calculator usage in the Level 1 exam include:

- Time Value of Money: This topic involves calculating present and future values of cash flows, determining bond yields and prices, and performing other calculations related to interest rates and time periods. A financial calculator is essential for these calculations.

- Quantitative Methods: Many of the topics in this area require the use of a financial calculator, including probability concepts, statistical concepts, and hypothesis testing.

- Corporate Finance: This topic requires calculations related to capital budgeting, valuation, and capital structure, all of which require the use of a financial calculator.

- Financial Reporting and Analysis: This area involves analyzing financial statements and performing ratio analysis. Although some of the calculations can be done manually, a financial calculator can be used to streamline the process and save time.

- Equity Investments: This area involves valuing equities, estimating dividends, and performing other calculations related to equity analysis. A financial calculator is useful for these calculations.

Overall, a financial calculator is an essential tool for the CFA Level 1 exam, as it is required for many of the calculations across multiple topics. It's important to ensure that you are familiar with the functions of the calculator and how to use it effectively before sitting for the exam.

Here is an estimate of the calculator usage for each topic in the CFA Level 1 exam:

| Topic | Calculator Uses |

|---|---|

| Quant | 80-90% |

| Corporate Issuers | 60-70% |

| Equity | 40-50% |

| FRA | 40-50% |

| Economics | 30-40% |

| Portfolio Management | 20-30% |

| Fixed Income | 20-30% |

| Alternative Investments | 10-20% |

| Derivatives | 5-8% |

| Ethics | 0% |

Which topics have the most math in CFA Level 1?

The CFA Level 1 exam covers a range of topics, some of which require more math than others. Here are some of the topic areas that require the most math:

- Quantitative Methods: This topic area covers a range of mathematical concepts such as time value of money, probability, statistical concepts and methods, and hypothesis testing. This section requires a strong foundation in mathematics, including algebra and calculus.

- Financial Reporting and Analysis: This topic area covers financial accounting and financial statement analysis, including topics such as ratio analysis, cash flow analysis, and inventory analysis. These topics require a good understanding of accounting principles and mathematical calculations.

- Corporate Finance: This topic area covers concepts such as capital budgeting, cost of capital, and dividend policy. These topics involve complex mathematical calculations, including the use of present value and discounted cash flow models.

- Equity Investments: This topic area covers concepts such as stock valuation, equity markets, and equity analysis. These topics require a good understanding of mathematics, including financial ratios and the use of various valuation models.

It is important to note that while these topic areas require more math, the CFA Level 1 exam is designed to test your understanding of the concepts, rather than your ability to perform complex mathematical calculations. Nonetheless, it is important to have a strong foundation in mathematics in order to succeed in these areas of the exam.

How much of the Level 1 exam includes Ethics and Professional Standards?

Ethics and Professional Standards is a significant part of the CFA Level 1 exam, comprising around 15% ( about 18 of the 120 questions) of the total exam weight. It covers the Code of Ethics and Standards of Professional Conduct, guiding investment professionals' behavior. This topic is crucial not only for the Level 1 exam but also for the entire CFA program and the ethical conduct of investment professionals throughout their careers.

What topics are covered under the Assets area?

In the CFA Level 1 exam, the Assets topic area covers a range of investment assets, including equity, fixed income, alternative, and derivative investments. Specifically, the Assets topic area includes the following sub-topics:

- Equity Investments: This sub-topic covers equity markets, equity analysis, and valuation techniques used in equity analysis.

- Fixed Income Investments: This sub-topic covers fixed income markets, fixed income securities, and valuation techniques used in fixed income analysis.

- Alternative Investments: This sub-topic covers investments in assets other than traditional stocks, bonds, and cash. Examples of alternative investments include real estate, commodities, and private equity.

- Derivatives: This sub-topic covers options, futures, forwards, and swaps. It includes understanding the mechanics of derivatives, pricing and valuation of derivatives, and their use in risk management and portfolio management.

Which Investment Tools are covered?

Investment tools are commonly used in investment analysis and management. These investment tools are tested across various topic areas and functional areas in the exam. Here are some of the investment tools that are covered in the CFA Level 1 exam

- Time value of money: This includes concepts such as present value, future value, annuities, and perpetuities.

- Statistical concepts and methods: This includes measures of central tendency, measures of dispersion, correlation, regression, and hypothesis testing.

- Financial ratios: This includes ratios related to liquidity, solvency, activity, profitability, and valuation.

- Portfolio management: This includes concepts such as portfolio construction, portfolio risk and return, and asset allocation.

- Equity valuation: This includes methods such as discounted cash flow analysis, dividend discount model, price-to-earnings ratio, and price-to-book ratio.

- Fixed income valuation: This includes concepts such as bond pricing, yield measures, and duration.

- Derivatives: This includes concepts such as forward contracts, futures contracts, options, and swaps.

- Alternative investments: This includes concepts related to real estate, commodities, hedge funds, and private equity.

Historical Changes and Revisions to the CFA Level 1 Topics

The CFA Level 1 curriculum for 2024 has completely transitioned to a Learning Module (LM) structure from the previous Readings format.

- Learning Modules are now essentially concise lessons intended to be completed in a single study session, better aligning with the typical study habits of CFA candidates. LMs also incorporate more visuals, spreadsheets, and practical content relevant to careers in finance.

- Comparing the 'number of readings/chapters' from the previous year is no longer a valid measure due to this structural shift. However, it still provides a useful benchmark for gauging the extent of the update. Notably, Portfolio Management, Derivatives, and Ethics remain largely consistent with the 2023 curriculum.

- In terms of specific subject areas, some topics have been further subdivided into Learning Modules, such as Fixed Income, Quantitative Methods, and Alternative Investments. Others have been either consolidated or refreshed, including Economics, Corporate Issuers, Financial Statement Analysis, and Equity.

| Topics/Weight | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Ethical and Professional Standards | 15% | 15-20% | 15-20% | 15-20% | 15-20% |

| Quantitative Methods | 10% | 8-12% | 8-12% | 8-12% | 6-9% |

| Economics | 10% | 8-12% | 8-12% | 8-12% | 6-9% |

| Financial Statement Analysis | 15% | 13-17% | 13-17% | 13-17% | 11-14% |

| Corporate Issuers | 10% | 8-12% | 8-12% | 8-12% | 6-9% |

| Fixed Income | 11% | 10-12% | 10-12% | 10-12% | 11-14% |

| Portfolio Management | 6% | 5-8% | 5-8% | 5-8% | 8-12% |

| Equity Valuation | 11% | 10-12% | 10-12% | 10-12% | 11-14% |

| Derivative Investments | 6% | 5-8% | 5-8% | 5-8% | 5-8% |

| Alternative Investments | 6% | 5-8% | 5-8% | 5-8% | 7-10% |